The construction industry has recovered from the pandemic quickly by most measures. Employment is near pre-pandemic levels and total construction spending is well above the early months of 2020, construction starts are growing and demand for architectural work remains strong. Despite much faster employment recovery than the rest of the economy, construction labor gains leveled off short of prepandemic levels and is approaching the general economy's average employment recovery.Carnegie Mellon University

Despite much faster employment recovery than the rest of the economy, construction labor gains leveled off short of prepandemic levels and is approaching the general economy's average employment recovery.Carnegie Mellon University

But residential construction spending remains above pre-pandemic levels thanks to a very strong 2020, and both residential and nonresidential construction volume has declined since the first of 2021.

“At some point over the next 12 months, this trend is expected to stabilize and reverse itself, and nonresidential construction will return to month-over-month growth,” says Henry D’Esposito. Nonresidential construction must reverse the momentum drag of a 25% drop in starts in 2020. “Based on the latest data available for new project starts that have occurred this year, overall construction volume is expected to begin growing in the spring of 2022.”

Two persistent challenges weakened construction’s 2021 recovery momentum and called into question some predictions for 2022:

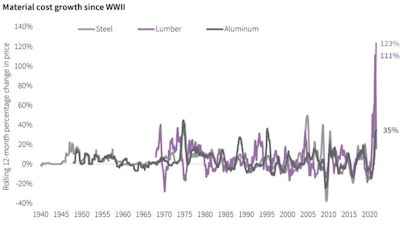

- Supply-chain delays and record-high costs of multiple key materials continue to pressure project execution and profitability

- COVID-19’s delta variant slowed economic growth, and future waves of the pandemic have potential to do the same

A materials and shipping crisis

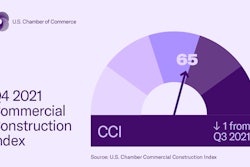

“Through August, average final construction costs for a commercial project had increased 4.5 percent, and total cost growth by year-end is likely to surpass 6 percent. A similar level of cost escalation, in the range of 4 to 7 percent, is expected into 2022,” says Henry D’Esposito, research manager for JLL’s construction group.”

The domestic trucking backlog has decreased since May, but are still well above pre-COVID 2019. Combined with persistent global shipping delays, JLL forecasts high costs and delays well into next year.DAT Freight and Analytics

The domestic trucking backlog has decreased since May, but are still well above pre-COVID 2019. Combined with persistent global shipping delays, JLL forecasts high costs and delays well into next year.DAT Freight and Analytics

Reached labor's limit?

Labor availability may already be having the greatest impact on contractors’ return to profitability.

“The lack of available labor has led to more project delays so far in 2021 than a lack of materials, and conditions are expected to worsen over the coming year.”

The construction labor market has mostly recovered from the pandemic, and falling unemployment rates over the last six months have coincided with steep wage increases. JLL forecasts construction labor costs will continue to grow in the next year at an elevated rate similar to the last six months, with wage increases in the 3 to 6 percent range expected.

Construction big labor gains leveled off short of prepandemic levels over the last six months, and the gap to prepandemic employment is approaching the general economy’s average.

Download JLL’s free H2 2021 Construction Outlook, with forecasts for construction volume, total construction costs, materials and labor costs and political implications.