There's not much talk about inflation related to the general economy, but rising costs have been eroding the construction spending much more insidiously.

Highway and bridge project costs have significantly outpaced general inflation (the Consumer Price Index) for most of the past decade, and will be up 2 to 4 percent again this year.

Alison Premo Black, chief economist with the American Road & Transportation Builders Association, says the differential is unlikely to change as the world economy recovers and drives disproportionate demand for energy, steel, cement and other construction materials.

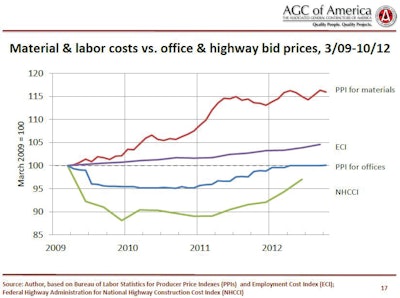

Ken Simonson, chief economist at the Associated General Contractors forecasts construction materials costs to continue to grow between 2013 and 2017 at 3 to 8 percent rates, compared to 2- to 3-percent CPI growth. The Employment Cost Index is also expected to rise 1.5 to 2.5 percent.

Simonson forecasts bid prices will grow at 2 to 5 percent rates through 2017.

Winning bids for highway construction projects, tracked by the Federal Highway Administration's National Highway Construction Cost Index, are rising from a late-recession dip, and have yet to regain their March 2009 levels. The producer price index for office buildings has done a little better, just regaining 2009 levels.

When you adjusted federal spending amounts for inflation, it has grown only a couple billion since 1998; perhaps not surprising given that the Highway Trust Fund has been funded at the same rate since 1993.

Inflation in construction materials costs is being driven by rising diesel prices, and intermittent sharp increases in steel, copper and gypsum-products prices.

Winning profitable contracts has never been so dependent on knowing your costs.