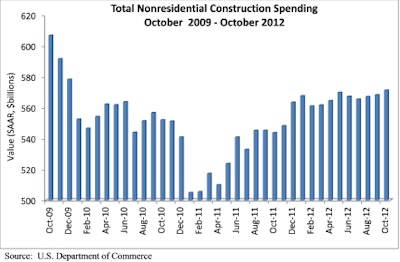

The nation’s nonresidential construction industry experienced a modest gain in October as spending increased 0.5 percent to $571.3 billion, according to the December 3 report by the U.S. Census Bureau. Total nonresidential construction spending - which includes both private and public projects - is up 5.1 percent compared to one year ago.

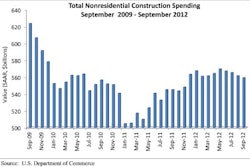

Nonresidential Construction Spending Down 0.4% in September

Private nonresidential construction spending increased 0.3 percent for the month and is up 10.7 percent year over year. Public nonresidential construction spending increased 0.8 percent for the month but is 0.4 percent lower than the same time last year.

Eleven of 16 nonresidential construction subsectors posted increases in October including:

- transportation, up 5.3 percent

- water supply, up 4.3 percent

- lodging, up 3.9 percent

Ten construction subsectors experienced increases in spending year over year including:

- lodging, up 29.3 percent

- transportation, up 21.2 percent

- power, up 19.2 percent

In contrast, five construction subsectors posted decreases in spending for the month including:

- communication, down 6.9 percent

- manufacturing, down 2.7 percent

- highway and street, down 2.3 percent

- sewage and waste disposal, down 1.7 percent

- conservation and development, down 1.5 percent

Construction subsectors registering decreases in year-over-year spending include:

- conservation and development, down 13.6 percent

- water supply, down 7.2 percent

- highway and street, down 4.8 percent

- communication, down 3.8 percent

- sewage and waste disposal, down 3.8 percent

- religious, down 3.7 percent

Residential construction spending jumped 3 percent for the month and is up 19.4 percent from the same time last year.

Total construction spending - which encompasses both nonresidential and residential spending - was up 1.4 percent for the month and is up 9.6 percent compared to October 2011.

“As the nation approaches its fiscal cliff - a collection of tax increases and spending cuts that kick in at the end of the year - the pattern of recovery in nonresidential construction spending has shifted,” said Associated Builders and Contractors Chief Economist Anirban Basu. “Earlier this year, private sector nonresidential construction spending growth was more robust but has since declined.

“This comes as little surprise as more projects are being put on hold,” Basu remarked. “The possibility of going over the cliff has dampened the pace of recovery.

“While recovery in private nonresidential construction spending has been suppressed, public spending on construction, which follows a different cycle, has been on the upturn,” said Basu. “Public nonresidential construction spending expanded 0.8 percent for the month and is now almost flat on a year-over-year basis.

“Transportation and water supply have been among the main public sector spending drivers,” Basu said. “This rise in spending is attributable to a combination of factors, including steadily improving state and local government budgets in much of the nation and ongoing investment in several large transportation-related construction projects across the U.S.

“There are two likely scenarios for nonresidential construction spending in the United States,” Basu said. “Both scenarios hinge upon the outcome of the fiscal cliff debate.

“Under one scenario, the nation falls back into recession, resulting in both diminished public and private nonresidential construction spending. Under the other scenario, a productive outcome on the fiscal cliff is achieved and nonresidential construction spending accelerates at some point in 2013 and into 2014.”

View the September spending report.