Even as the U.S. steel industry fights to keep tariffs in place, the construction industry faces an ongoing struggle as rising materials prices, and steel in particular, eat away at profit margins and delay or halt some projects due to runaway construction costs. And relief is unlikely to come in any form soon. Anirban Basu, chief economist, Sage Policy Group, believes the industry is on the edge of the precipice, with a “tsunami of demand” ahead as the U.S. economy opens further and continues to drive up material prices.

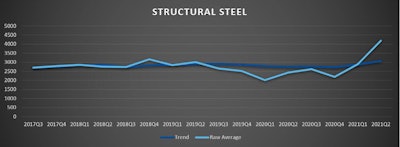

Steel has seen particularly dramatic increases over the past year, with price growth expected to continue for the foreseeable future. According to the Q2 2021 update from Gordian’s Construction Cost Database, the price of structural steel has risen 91% since the fourth quarter of 2020, and is up 45% in the past quarter alone. A poll conducted by S&P Global Platts of 91 participants in its Steel Markets North America (SMNA) virtual conference showed more than half expect U.S. finished steel prices to remain at their current highs or rise further in the coming six months. Of the 44% who expect to see domestic finished steel prices increase, 22% expect prices to rise by more than 10%. According to Gordian, the price of structural steel has risen 91% since the fourth quarter of 2020.Gordian’s Construction Cost Database

According to Gordian, the price of structural steel has risen 91% since the fourth quarter of 2020.Gordian’s Construction Cost Database

Four Contributing Factors

Gordian regularly collects, validates and analyzes North American construction material costs to maintain RSMeans data, its construction costs database. Its data team has identified four contributing factors for the unprecedented price increases in steel:

- Steel Fabrication Costs: Fabrication costs are largely influenced by wage rates and the energy required to shape, cut, drill and weld. While some steel used in the U.S. is produced overseas, most of it is made domestically. This means that fabrication wages for the majority of domestic steel products will follow the rise and fall of the national working wage rate, which is growing. And while green technology is starting to reduce energy costs for many businesses, steel fabrication facilities require an impressive amount of power to operate.

- Installation Labor: Installation costs, like fabrication costs, are directly linked to wages, and domestic wage rates are projected to continue their hike upward. The current employment levels in the U.S. have also created a shortage of available labor. This means that employers are paying extra to secure and keep workers on staff. Areas more affected by the labor shortage will likely see a correlating bump in installation costs.

- Transportation Costs and Tariffs: Over its life, steel is moved from the mill to the fabricator then on to the jobsite. Each mile the material moves will add more to its cost. In addition to driver wages, transportation costs – including fuel, equipment maintenance and insurance coverage – tend to go up year over year. The providers will inevitably pass those costs along to the end user in the form of material price increases. Import taxes and duties, which include tariffs, also factor into transportation costs. The U.S. is currently carrying 25% tariffs on steel imports against many nations.

- Supply and Demand: The impacts of the pandemic hit industrial manufacturers and factories hard, especially those that depend on workers whose jobs cannot be carried out remotely. The effect of public health requirements and COVID-19 outbreaks was a halt or delay in production and thousands of jobs lost. Through the worst of the pandemic, the U.S. saw thousands of iron and steel production jobs disappear nationwide. With businesses starting to ramp up operations, there is a nationwide clamor for commodities such as aluminum, drywall and lumber. The high-demand nature of the pandemic recovery has emptied stressed supply chains and inflated prices at a rate we have not seen in recent years.

While there are those who believe that steel demand, and prices, will taper in the coming months as more production comes online, others see no clear end in sight as domestic suppliers stumble in restoring capacities and imported suppliers take a double hit from tariffs and jumps in ocean freight costs. In a recent economic webinar hosted by the National Fluid Power Association (NFPA), James Meil, ACT Research, predicted year-end 2022 as a possibility for starting to see demand settle and supplies catching up, with a corresponding reduction in steel prices.

But should increased infrastructure funding legislation come to be passed, prospects for an ease in pricing could be pushed out even further into the future, and add to the question of how high prices could actually go if the resulting steel demand can’t be met in a timely and cost-effective manner.