- 12 consecutive month of economic growth in the services sector.

- ISM expects growth to continue throughout the next quarter.

- Pricing, labor an issue for most.

- Construction sector see growth, as well as supply and labor shortages.

Construction experienced the third largest growth among the 18 industries in the service sector in May, according to a report issued June 3 by the Institute of Supply Management (ISM).

Anthony Nieves, chair of the ISM Services Business Survey Committee, delivered the services sector Purchasing Managers’ Index (PMI) report. The index is a set of economic indicators based off surveys of private-sector companies.

“According to the Services PMI, all 18 services industries reported growth. The composite index indicated growth for the 12th consecutive month after a two-month contraction in April and May 2020," he says. "There was continued growth in the services sector in May. The rate of expansion is very strong, as businesses have reopened and production capacity has increased. However, some capacity constraints, material shortages, weather-related delays, and challenges in logistics and employment resources continue."

The 18 services industries reporting growth in May, in order of growth, are: retail trade; wholesale trade; construction; arts, entertainment and recreation; transportation and warehousing; real estate, rental and leasing; mining; finance and insurance; management of companies and support services; utilities; other services; information; accommodation and food services; health care and social assistance; agriculture, forestry, fishing and hunting; public administration; professional, scientific and technical services; and educational services.

“We are still busy and adding employees," one construction industry survey respondent says. "One of the biggest concerns now is shortages of crucial material and equipment. Metal coils for production are especially scarce. Equipment and material suppliers have been raising prices since the first of the year. We hear of a new increase almost daily.”

Historical look at the ISM Services PMI.ISM

Historical look at the ISM Services PMI.ISM

Another All-Time High

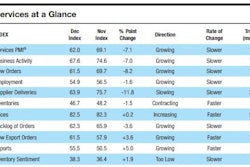

The ISM Services PMI for May came in at 64.0, following April's reading of 62.7 and 63.7 in March.

The number shows that the services sector grew for the 12th consecutive month, after two months of contraction and 122 months of growth before that. A reading above 50% indicates the services sector economy is generally expanding; below 50% indicates the services sector is generally contracting. A Services PMI above 49.2%, shows that the overall economy is growing. “The past relationship between the Services PMI and the overall economy indicates that the Services PMI for May (64%) corresponds to a 5.2% increase in real gross domestic product (GDP) on an annualized basis," Nieves says.

ISM’s Business Activity Index registered 66.2% in May, an increase of 3.5 percentage points from the April reading of 62.7%. This represents growth for the 12th consecutive month. Several survey respondents mentioned pent-up demand leading to increased business activity: “Pent-up patient demand for services” and “Increased demand associated with businesses reopening as a result of greater access to COVID-19 vaccinations.”

Nieves likened the pent-up demand for goods and services to a jail break.

"If you visualize the increased traffic on the roads and at businesses, the demand is real. It's almost like a jail break," he says.

While Nieves says he expects the pace of record-breaking growth to continue through the end of the next quarter, it will eventually level off, like all economic spikes do.

"It has to, it always does," he says.

ISM’s Services Employment Index.ISM

ISM’s Services Employment Index.ISM

Labor Shortages Continue

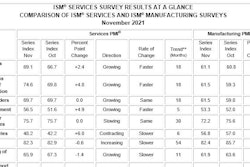

Employment scarcity continues for another month, the report indicates. Employment grew for the fifth consecutive month in May after contracting in December. The Employment Index registered 55.3% in May, down 3.5 percentage points from the April reading of 58.8%. Comments from respondents include, “Competition for labor continues to intensify due to lack of available talent pool” and “Working to fill vacant positions; difficulty in finding qualified candidates.”

The 10 industries reporting an increase in employment in May, in order, are: arts, entertainment and recreation; real estate, rental and leasing; retail trade; construction; finance and insurance; wholesale trade; mining; transportation and warehousing; public administration; and utilities. the three industries that reported a reduction in employment in may are: accommodation and food services; agriculture, forestry, fishing and hunting; and educational services.

ISM’s Services Supplier Deliveries Index.ISM

ISM’s Services Supplier Deliveries Index.ISM

Slow Deliveries, Low Inventory

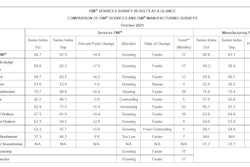

Service sector industries experienced slow deliveries in May and while inventory levels are improving, they aren't where they need to be, Nieves says.

The Supplier Deliveries Index registered 70.4%, which is 4.3 percentage points higher than the 66.1% reported in April. A reading above 50% indicates slower deliveries, while a reading below 50% indicates faster deliveries. Comments from respondents include, “Port congestion continues to delay product deliveries” and “Manufacturers continue to indicate capacity, employment and other issues are impacting the demand-versus-supply ratio.”

Construction was one of the industries reporting the greatest slowdowns of deliveries. The 17 industries reporting slower deliveries in May, listed in order, are: accommodation and food services; management of companies and support services; wholesale trade; transportation and warehousing; construction; agriculture, forestry, fishing and hunting; real estate, rental and leasing; utilities; other services; retail trade; mining; information; health care and social assistance; professional, scientific and technical services; finance and insurance; public administration; and educational services.

Meanwhile, the Inventories Index grew in May after contracting in April. The reading of 51.5% was a 2.4-percentage point increase from the 49.1% reported in April. Of the total respondents in May, 38% indicated they do not have inventories or do not measure them. Comments from respondents include, “Longer lead times affecting safety stock” and “Problems with logistics is driving up inventory levels.”

Nieves says that while inventories for most industries improved somewhat, levels are lower than what they should be. Inventory sentiment decreased for most industries, meaning that executives feel their inventories are too low. A few industries, however, including construction, expressed that their inventories were too high. The five industries reporting sentiment that their inventories were too high in May are: arts, entertainment and recreation; health care and social assistance; utilities; mining and construction.

The ISM PMI May Pricing Index.ISM

The ISM PMI May Pricing Index.ISM

Pricing Remains High

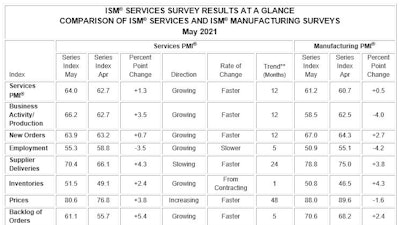

Prices paid by service organizations for materials and services increased in May, with the index registering 80.6%. The only time the Prices Index has been higher was in September 2005, when it hit 83.5%. The May figure is 3.8 percentage points higher than April’s reading of 76.8%, which was the highest reading since July 2008, when it was at 77.4%.

All 18 services industries reported an increase in prices paid during the month of May, in order: real estate, rental and leasing; wholesale trade; construction; agriculture, forestry, fishing and hunting; transportation and warehousing; accommodation and food services; utilities; management of companies and support services; public administration; arts, entertainment and recreation; finance and insurance; mining; other services; retail trade; professional, scientific and technical services; educational services; information; and health care and social assistance.

Commodities up in price include: aluminum products (2); beef; chicken; computer products; construction materials (3); copper; copper wire (2); corn; corrugated boxes (2); diesel (6); electrical components (4); electronic components (2); equipment; exam gloves; food; freight; fuel (5); gasoline (6); gasoline-related products; integrated circuits; labor (6); labor — construction (3); labor — skilled; labor — temporary (5); logistics services; lumber (5); lumber products; maintenance services; metal products; nitrile gloves (2); oriented strand board (OSB) (6); packaging materials; pallets; pharmaceuticals; plastic products; plywood; polyvinyl chloride (PVC) (2); polyvinyl chloride (PVC) products (9); resin products (5); rubber-based products; steel (9); steel — carbon; steel products (5); transportation; and trucking services. The number of consecutive months the commodity is listed is indicated after each item.