- Record-setting economic expansion in October

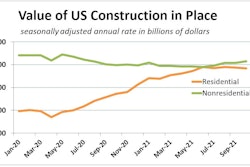

- Supply chain bottlenecks continue to hamper construction

- Executives increase orders in attempt to alleviate supply chain disruptions

- Inflation expected to continue into third quarter of 2022

- Consumer demand continues to increase

- Labor shortages at ports, warehouses continue to impact inventories

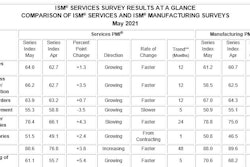

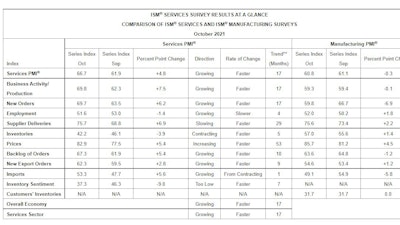

Economic expansion in the services sector grew at a record pace in October, according to a report released today. The Services ISM Report on Business, issued by the Institute for Supply Chain Management (ISM), measures economic growth and sentiment based upon surveys with industry executives in the services sector, which includes construction. The rate of economic expansion set a record for the fourth time in 2021 and economic activity grew for the 17th month in a row within the sector, according to the report.

“In October, the Services PMI registered another all-time high of 66.7%, 4.8 percentage points above September’s reading of 61.9%. This figure exceeds the former all-time high of 64.1% in July; previous records were set in May at 64% and March at 63.7%,” says Anthony Nieves, chair of the Institute for Supply Management (ISM) Services Business Survey Committee.

While consumer demand for products remains high, growth continued to increase in October as industries orders more products in hopes of overcoming supply chain issues. Inventories in short supply and the inability to replenish them fast enough is leading industry executives to increase the frequency and quantities of orders to accelerate to prepare for their busy season and alleviate the pressure of not having enough products, Nieves says.

“A lot of the respondents attribute this growth to not only the increase in demand but also pushing forward orders to get ready for peak season, as well as, because of the (supply chain) bottlenecks, they’re trying to accelerate both the frequency and quantity in hopes of trying to alleviate the supply disruption,” he says. “Respondents are telling us they cannot restock their (inventory) supplies fast enough.”

A lack of workers in the supply chain industry and in warehousing is causing congestion at the ports, he says.

“We know that from watching the ports on the West Coast and specifically Long Beach (Calif.) and the port of Los Angeles, there are about 100 ships just sitting there just waiting to offload,” he says. “We know there are challenges with capacity as far as space, lack of truck drivers and equipment to pull it off of the ports, as well as not having enough warehouse people, even with the increase of ships’ longshoremen; it’s still causing a bottleneck because the linkage there is not fully staffed.”

Since 30% of products come through those two ports, the shortage is causing havoc in the supply chain industry. A similar situation is happening in New Orleans and at ports throughout the Gulf of Mexico, he says.

He says the demand explains the elevated Services PMI reading, as two of the four equally weighted subindexes that directly factor into the composite index set all-time highs: The Business Activity Index reached 69.8%, an increase of 7.5 percentage points compared to the reading of 62.3% in September. Meanwhile, the New Orders Index hit 69.7%, up 6.2 percentage points from last month’s figure of 63.5%.

“Demand shows no signs of slowing, reflected by two other subindexes in October,” he says.

The Supplier Deliveries Index registered 75.7%, up 6.9 percentage points from September’s reading of 68.8%. The all-time high is 78.3%, recorded in April 2020. Supplier Deliveries is the only ISM Report on Business index that is inversed; a reading of above 50% indicates slower deliveries, which is typical as the economy improves and customer demand increases.

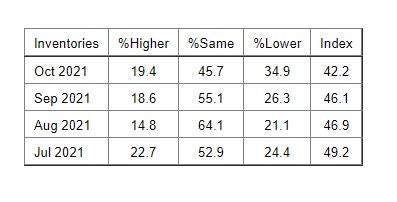

The Backlog of Orders Index set a record of 67.3%, 5.4 percentage points higher than the September reading of 61.9%; the previous high of 65.8% was set in June. The Prices Index reached its second-highest reading ever at 82.9%, up 5.4 percentage points from the September figure of 77.5% and exceeded only by September 2005 (83.5%). In response, services businesses are struggling to stock up, as the Inventories Index (42.2%, down 3.9 percentage points from September’s reading of 46.1%) and the Inventory Sentiment Index (37.3%, a decrease of 9 percentage points from 46.3% the previous month) were near record lows in October.

“In October, strong growth continued for the services sector, which has expanded for all but two of the last 141 months,” Nieves says. “However, ongoing challenges — including supply chain disruptions and shortages of labor and materials — are constraining capacity and impacting overall business conditions.”

The 18 services industries reporting growth in October, listed in order, are: retail trade; transportation and warehousing; real estate, rental and leasing; arts, entertainment and recreation; other services; utilities; construction; information; educational services; wholesale trade; accommodation and food services; health care and social assistance; agriculture, forestry, fishing and hunting; management of companies and support services; finance and insurance; professional, scientific and technical services; public administration; and mining.

“Supply chain disruptions continue to roil new residential construction,” one survey respondent in the construction industry reports. “Material and skilled labor shortages are lengthening cycle times and forcing substitutions.”

Survey respondents are expecting inflation to continue into the third quarter of 2022.

“Most of the respondents are saying that in the past they thought it might be something that would be alleviated in the first/second quarter of 2022; now they’re projecting it to be even further out,” Nieves says.

Inventories are Too Low

The ISM Services Inventory Sentiment Index contracted in October for the seventh consecutive month, registering 37.3%, 9 percentage points lower than September’s figure of 46.3%. This reading is just 0.1 percentage point higher than the all-time low of 37.2% registered in June. This indicates that respondents feel their inventories are too low when correlated to business activity levels.

The two industries reporting sentiment that their inventories were too high in October are: arts, entertainment and recreation; and construction. The 10 industries reporting a feeling that their inventories were too low in October, listed in order, are: real estate, rental and leasing; retail trade; mining; professional, scientific and technical services; information; transportation and warehousing; public administration; wholesale trade; utilities; and health care and social assistance. Six industries reported no change in October compared to September.  ISM

ISM

Business Activity

ISM’s Business Activity Index registered an all-time high of 69.8% in October, an increase of 7.5 percentage points from the September reading of 62.3% and surpassing the previous mark of 69.4% in March, indicating growth for the 17th consecutive month.

“Longer lead times are driving more orders and more quantities,” a survey respondent reports. “Ramping up for peak season.”

The 17 industries reporting an increase in business activity for the month of October, listed in order, are: real estate, rental and leasing; retail trade; information; transportation and warehousing; educational services; utilities; health care and social assistance; arts, entertainment and recreation; mining; wholesale trade; finance and insurance; management of companies and support services; other services; construction; accommodation and food services; professional, scientific and technical services; and public administration. The only industry reporting unchanged in October is agriculture, forestry, fishing and hunting.

ISM

ISM

New Orders

ISM’s New Orders Index registered a record 69.7%, an increase of 6.2 percentage points from the September reading of 63.5%. The previous all-time high was 67.2% in March. New orders grew for the 17th consecutive month after two months of contraction and a preceding period of 128 months of expansion.

“Increase in new business in a developing sector of our company,” a survey respondent says. “Pulling orders forward in order to contain constraint impact.”

The 16 industries that reported growth of new orders in October, listed in order, are: retail trade; transportation and warehousing; other services; real estate, rental and leasing; utilities; information; management of companies and support services; accommodation and food services; arts, entertainment and recreation; health care and social assistance; wholesale trade; construction; educational services; finance and insurance; professional, scientific and technical services; and public administration. No industries reported a decrease in new orders in October.

ISM

ISM

Employment

Employment activity in the services sector grew in October for the fourth consecutive month after contracting in June. ISM’s Services Employment Index registered 51.6% in October, down 1.4 percentage points from the September reading of 53%.

“Staffing and turnover remain significant challenges,” one survey respondent says. “Continued difficulty filling positions, especially front-line.”

“Drivers are in short supply; rate of turnover has increased,” another reports.

The 12 industries reporting an increase in employment in October, listed in order, are: arts, entertainment and recreation; agriculture, forestry, fishing and hunting; transportation and warehousing; construction; retail trade; wholesale trade; educational services; other services; information; utilities; finance and insurance; and professional, scientific and technical services. The four industries that reported a reduction in employment in October are management of companies and support services; public administration; health care and social assistance; and accommodation and food services.

ISM

ISM

Supplier Deliveries

The Supplier Deliveries Index registered 75.7%, 6.9 percentage points higher than the 68.8% reported in September. This is the index’s second-highest reading since its record high of 78.3% in April 2020. A reading above 50% indicates slower deliveries, while a reading below 50% indicates faster deliveries.

“Lack of drivers and warehouse labor,” one survey respondent says. “Capacity constraints, raw material shortages, labor shortages and transportation delays.”

The 17 industries reporting slower deliveries in October, listed in order, are: real estate, rental and leasing; retail trade; accommodation and food services; construction; utilities; health care and social assistance; transportation and warehousing; educational services; management of companies and support services; other services; agriculture, forestry, fishing and hunting; wholesale trade; public administration; arts, entertainment and recreation; professional, scientific and technical services; information; and finance and insurance. No industries reported faster supplier deliveries in October.

Inventories

According to the report, the Inventories Index contracted in October for the fifth consecutive month. The reading of 42.2% was a 3.9-percentage point decrease from the 46.1% reported in September. Of the total respondents in October, 39% indicated they do not have inventories or do not measure them.

“Trying to increase, but very difficult to do so due to availability and transportation,” one survey respondent says. “Inflation is creating lower inventory levels due to costs.”

The six industries reporting an increase in inventories in October, listed in order, are: arts, entertainment and recreation; accommodation and food services; construction; educational services; utilities; and health care and social assistance. The six industries reporting a decrease in inventories in October, listed in order, are: real estate, rental and leasing; mining; retail trade; transportation and warehousing; professional, scientific and technical services; and information. Six industries reported no change in October versus September.

“Construction remains quite strong, although material supply issues persist,” a survey respondent from the real estate, rental and leasing sector reports.

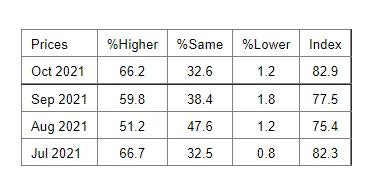

Prices

Prices continue to be high, survey respondents report.

Prices paid by services organizations for materials and services increased in October, with the index registering 82.9%, 5.4 percentage points higher than September’s reading of 77.5%. This is the highest reading since September 2005, when the index reached its all-time high of 83.5%.

All 18 services industries reported an increase in prices paid during the month of October, in the following order: arts, entertainment and recreation; real estate, rental and leasing; management of companies and support services; wholesale trade; utilities; other services; public administration; transportation and warehousing; educational services; retail trade; information; construction; accommodation and food services; agriculture, forestry, fishing and hunting; professional, scientific and technical services; finance and insurance; mining; and health care and social assistance.

ISM

ISM

Backlog of Orders

The ISM Services Backlog of Orders Index grew in October for the 16th time in the last 17 months. The index registered a record 67.3%, a 5.4-percentage point increase compared to the 61.9% reported in September. The previous all-time high was 65.8% in June. Of the total respondents in October, 43% indicated they do not measure backlog of orders.

The 14 industries reporting an increase in order backlogs in October, listed in order, are: agriculture, forestry, fishing and hunting; accommodation and food services; management of companies and support services; real estate, rental and leasing; wholesale trade; utilities; health care and social assistance; information; professional, scientific and technical services; other services; transportation and warehousing; public administration; construction; and retail trade. The one industry that reported a decrease in backlogs in October is mining.

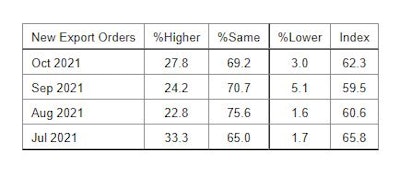

New Export Orders

Orders and requests for services and other non-manufacturing activities to be provided outside of the U.S. by domestically-based companies grew in October for the ninth consecutive month. The New Export Orders Index registered 62.3%, 2.8 percentage points higher than the 59.5% reported in September. Of the total respondents in October, 75% indicated they either do not perform, or do not separately measure, orders for work outside of the U.S.

The eight industries reporting an increase in new export orders in October, listed in order, are: real estate, rental and leasing; accommodation and food services; construction; information; transportation and warehousing; wholesale trade; finance and insurance; and professional, scientific and technical services. The two industries reporting a decrease in new export orders in October are: utilities; and educational services. Eight industries reported no change in exports.

ISM

ISM

Imports Index

The Imports Index grew in October after two consecutive months of contraction, as it registered 53.3%, 5.6 percentage points higher than September’s figure of 47.7%. Seventy-one percent of respondents reported that they do not use, or do not track the use of, imported materials.

The six industries reporting an increase in imports for the month of October, listed in order, are: retail trade; educational services; finance and insurance; transportation and warehousing; construction; and wholesale trade. The two industries reporting a decrease in imports in October are: health care and social assistance; and professional, scientific and technical services. Ten industries reported no change in imports in October.

Commodities

The following commodities are up in price (the number of consecutive months the commodity is listed is indicated after each item): aluminum (4); aluminum products (2); beef (2); chemicals (2); chicken (2); chips; construction contractors (4); copper; copper products (4); corrugated products (2); dairy; diesel fuel (11); electrical components (9); electronics (2); food (2); food and beverages (3); freight (6); fuel (10); gasoline (11); integrated circuits; labor (11); labor — construction (3); labor — temporary (10); logistics services (2); metals; metal-based products; natural gas; ocean freight (2); pallets; petroleum products; plastic products (3); poly film products (2); polyvinyl chloride (PVC) products (2); resin-based products (4); security services; software licensing; software maintenance and support; steel; steel products (10); and transportation costs.

Lumber is the only commodity down in price.

Commodities in short supply include: appliances; blood collection tubes (2); chicken (2); computer equipment (3); construction contractors (2); construction subcontractors (3); crutches; electrical components (2); integrated circuits; labor (3); labor — technology and web-related; labor — temporary (10); laptops and desktop computers (3); microchips (3); needles and syringes (3); ocean freight containers (2); pallets; paper products; pipette (8); plastic pipe; plastics; portion control condiment packets; polyvinyl chloride (PVC) products; stainless steel products; steel products (2); transportation; and vacutainers.