The Institute for Supply Management (ISM) released its monthly economic report today on the country’s services sector, which includes industries such as construction, retail and wholesale trade, information services and more. The report shows continued growth for the economy in April, with construction positioned as the fastest-growing sector. Known as the Purchasing Managers’ Index (PMI), the report is created using a set of economic indicators based off surveys of private-sector companies.

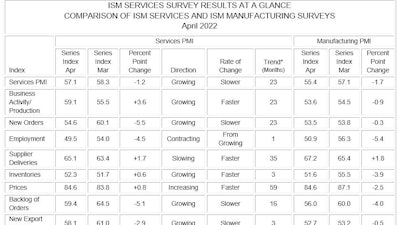

April’s PMI is 57.1%, slightly lower than it was in March, according to Anthony Nieves, chair of the ISM Services Business Survey Committee.

“In April, the Services PMI registered 57.1%, 1.2 percentage points lower than March’s reading of 58.3%,” he said. “The Business Activity Index registered 59.1%, an increase of 3.6 percentage points compared to the reading of 55.5% in March, and the New Orders Index figure of 54.6% is 5.5 percentage points lower than the March reading of 60.1%.”

An executive from the construction industry reported, “Mortgage rates have skyrocketed. While relatively low from a historical perspective, the new rates — combined with historically high home prices — will temper new home demand at some point over the next 12 months.”

Meanwhile, an executive in wholesale trade reported, “Cost pressures beginning to slow demand.”

A Services PMI above 50.1 %, over time, generally indicates an expansion of the overall economy. Therefore, the April Services PMI indicates the overall economy has followed the same path as the services sector: expansion for 23 straight months following two months of contraction and a preceding period of 122 months of growth. Nieves says, “The past relationship between the Services PMI and the overall economy indicates that the Services PMI for April (57.1 %) corresponds to a 2.5-% increase in real gross domestic product (GDP) on an annualized basis.”

Yesterday, the ISM released its Manufacturing PMI for April, which came in at 55.4%, a decrease of 1.7% and the lowest reading since July 2020.

Timothy Fiore, chair of the ISM Manufacturing Business Survey Committee, who delivered the ISM Manufacturing report on May 3, said workforce shortages were driving the dip. He said executives were optimistic about demand, but are worried about labor, energy markets, supply chain and pricing issues.

“The U.S. manufacturing sector remains in a demand-driven, supply chain-constrained environment,” said Timothy Fiore, chair of the ISM Manufacturing Business Survey Committee. “In April, progress slowed in solving labor shortage problems at all tiers of the supply chain. Panelists reported higher rates of quits compared to previous months, with fewer panelists reporting improvement in meeting head-count targets. April saw a slight easing of prices expansion, but instability in global energy markets continues. Surcharge increase activity across all industry sectors continues. Panel sentiment remained strongly optimistic regarding demand, though the three positive growth comments for every cautious comment was down from March’s ratio of 6-to-1, Panelists continue to note supply chain and pricing issues as their biggest concerns.”

A Manufacturing PMI above 48.7%, over a period of time, generally indicates an expansion of the overall economy. Therefore, the April Manufacturing PMI indicates the overall economy grew in April for the 23rd consecutive month following contraction in April and May 2020. “The past relationship between the Manufacturing PMI and the overall economy indicates that the Manufacturing PMI for April (55.4%) corresponds to a 2.3%increase in real gross domestic product (GDP) on an annualized basis,” said Fiore.

He said that overseas partners are experiencing COVID-19 impacts, creating a near-term headwind for the U.S. manufacturing community. Fifteen percent of panelists’ general comments expressed concern about their Asian partners’ ability to deliver reliably in the summer months, up from 5 percent in March, Fiore said.

Within the Services Index for April, 17 industries reported growth. Growth continues for the services sector, which has expanded for all but two of the last 147 months. There was a pullback in the composite index, mostly due to the restricted labor pool (impacting the Employment Index) and the slowing of new orders growth. Business activity remains strong; however, high inflation, capacity constraints and logistical challenges are impediments, and the Russia-Ukraine war continues to affect material costs, most notably of fuel and chemicals, the report stated.

The 17 services industries reporting growth in April, listed in order, are: construction; utilities; management of companies and support services; real estate, rental and leasing; accommodation and food services; public administration; professional, scientific and technical services; educational services; mining; transportation and warehousing; wholesale trade; finance and insurance; other services; health care and social assistance; retail trade; arts, entertainment and recreation; and agriculture, forestry, fishing and hunting.

Employment activity in the services sector contracted in April. ISM’s Employment Index registered 49.5%, down 4.5 percentage points from the reading of 54% registered in March. Comments from respondents include, “Job openings exist, but finding talent to fill them remains a struggle across most industry sectors and job categories” and “Demand for employment remains hypercompetitive; there is just not enough qualified personnel available.”

Prices paid by services organizations for materials and services increased in April for the 59th consecutive month, with the index registering 84.6%, 0.8 percentage point higher than the March figure of 83.8%. This is highest reading ever, exceeding the seasonally adjusted figure of 83.9% registered in December 2021.