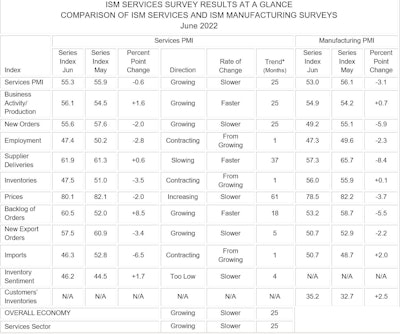

A business index based on the feedback of executives in the services industries, including construction, shows a decline in the overall index, but continued overall economic growth.

The Institute for Supply Management (ISM) issued its Services ISM Report on Business for June, which came in at 55.3%, is 0.6% lower than May. Economic activity grew for the 25th month in a row, however, according to Anthony Nieves, chair of the (ISM) Services Business Survey Committee. The ISM Services PMI index is a set of economic indicators based off surveys of private-sector companies in the services sector, which includes construction. Construction was the fourth fastest growing sector in the services industry report.

“According to the Services PMI, all 18 industries reported growth,” Nieves said. “The composite index indicated growth for the 25th consecutive month after a two-month contraction in April and May 2020. Growth continues, albeit slower, for the services sector, which has expanded for all but two of the last 149 months. The slight slowdown in services sector growth was due to a decline in new orders and employment. The Employment Index (47.4%) contracted, and the Backlog of Orders Index grew 8.5 percentage points, to 60.5%. Logistical challenges, a restricted labor pool, material shortages, inflation, the coronavirus pandemic and the war in Ukraine continue to negatively impact the services sector.”

The Business Activity Index registered 56.1%, an increase of 1.6 percentage points compared to the reading of 54.5% in May. The New Orders Index figure of 55.6% is 2 percentage points lower than the May reading of 57.6%.

“(Interest) rate increases have slowed sales but have not helped with supply challenges yet," one construction executive reported.

The Supplier Deliveries Index registered 61.9%, 0.6 percentage point higher than the 61.3% reported in May. Supplier Deliveries is the only ISM Report On Business index that is inversed; a reading of above 50% indicates slower deliveries, which is typical as the economy improves and customer demand increases. The Prices Index dropped for the second consecutive month in June, decreasing 2 percentage points to 80.1%.

Services businesses continue to struggle to replenish inventories, as the Inventories Index contracted for the first time since January 2022; the reading of 47.5% is down 3.5 percentage points from May’s figure of 51%.

“The Inventory Sentiment Index (46.2%, up 1.7 percentage points from May’s reading of 44.5%) contracted in June for the fourth consecutive month, indicating that inventories are in ‘too low’ territory and insufficient for current business requirements,” he said.

Commodities Pricing

The following commodities are up in price for the month (the number of consecutive months the commodity is listed is indicated after each item): aluminum products (7), chemicals (3), chicken (10), construction materials (2), diesel fuel (19), electrical components (17), electronic components (7), food and beverages (3), food products (4), fuel (18), fuel-related products (4), gasoline (19), hotel rates (2), janitorial supplies, lab supplies, labor (19), labor — temporary (5), logistics services, paint, plastic products (11), resin (2), steel products (18), transformers, travel (2) and wire cable.

Commodities lower in price include: cleaning supplies, lumber, oriented strand board (OSB) and polyvinyl chloride (PVC) products.

Commodities in short supply include: appliances (4), baby formula (2), contrast media (2), diesel fuel (2), electrical components (3), electronic components (7), garage doors, lab supplies, labor (11), microchips (2), needles and syringes (6), paper products (4), sugar and transformers (2).

June Services PMI

The 12-month Services PMI average is 60.8%, reflecting consistent growth in the services sector, which has expanded for 25 consecutive months. The June reading, at 55.3%, however, set a 12-month low for a second consecutive month and is the lowest since May 2020, when the index registered 45.2%. A reading above 50% indicates the services sector economy is generally expanding; below 50% indicates the services sector is generally contracting.

“The past relationship between the Services PMI and the overall economy indicates that the Services PMI for June (55.3%) corresponds to a 1.9% increase in real gross domestic product (GDP) on an annualized basis,” Nieves said.

Business Activity

Construction was one of the top performing sectors in the Services report.

ISM’s Business Activity Index registered 56.1% in June, an increase of 1.6 percentage points from the reading of 54.5% in May, indicating growth for the 25th consecutive month. Comments from respondents include: “Higher customer demand and more capacity online” and “Business is higher but slower than expected due to summer holidays, customers and employees are on vacation.”

The 15 industries reporting an increase in business activity for the month of June, listed in order, are: management of companies and support services, construction, other services, accommodation and food services, arts, entertainment and recreation, mining, professional, scientific and technical services, utilities, finance and insurance, wholesale trade, educational services, health care and social assistance, information, transportation and warehousing and public administration.

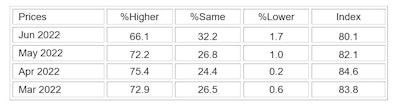

Pricing

Pricing increased once again for businesses. According to the report, prices paid by services organizations for materials and services increased in June for the 61st consecutive month, with the index registering 80.1%, 2 percentage points lower than the 82.1% that was recorded in May.

All services industries reported an increase in prices paid during the month of June, in the following order: arts, entertainment and recreation, mining, transportation and warehousing, public administration, retail trade, accommodation and food services, educational services, wholesale trade, information, professional, scientific and technical services, real estate, rental and leasing, finance and insurance, construction, utilities, health care and social assistance, management of companies and support services, other services, and agriculture, forestry, fishing and hunting.

Employment

Construction employment was up for June, which isn't a surprise given the season. Overall, labor numbers decreased last month.

According to the report, employment activity in the services sector contracted in June for the third time in the last five months. ISM’s Employment Index registered 47.4%, down 2.8 percentage points from the reading of 50.2% registered in May. Comments from respondents include, “Unable to fill positions with qualified applicants” and “Extremely hard to find truck drivers.” Also, “Demand for talent is higher, but availability of candidates to fill open roles continues to keep employment levels from increasing.”

The seven industries reporting an increase in employment in June, listed in order, are: mining, construction, wholesale trade, other services, professional, scientific and technical services, public administration, and health care and social assistance. the five industries reporting a decrease in employment in june are: real estate, rental and leasing, agriculture, forestry, fishing and hunting, accommodation and food services, finance and insurance, and educational services. Six industries reported no change in June.