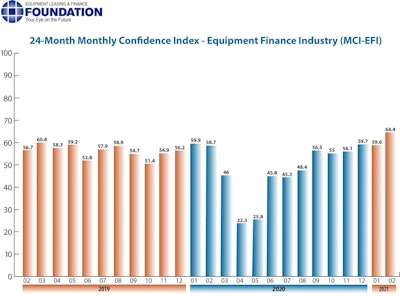

Confidence within the equipment finance market rose nearly five points in February to 64.4 compared to 59.6 for the previous month, the Equipment Leasing & Finance Foundation reports in its February 2021 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI). The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector.

Rising confidence among equipment finance executives is indicative of the strength of demand for equipment in the market segments they serve, including the construction sector. Many industry leaders are seeing emerging pent-up demand in the wake of the pandemic.

According to survey respondent David Normandin, CLFP, president and CEO, Wintrust Specialty Finance, his company had a solid year of growth in spite of the global pandemic. “2021 has started out well with strong application flow, approval rates and funding volume. Additionally, the portfolio has performed with low delinquency and credit quality,” he stated. “I expect that mid-year will bring challenges as PPP funds fade. However, we are focused in industries that are performing with essential use collateral that we believe will continue to perform.”

Michael Romanowski, president, Farm Credit Leasing, said his company is seeing pent-up demand for equipment and structure investment. “Due to the continued uncertainty caused by COVID and the low interest rate environment, customers are preferring to finance rather than pay cash,” he pointed out.

Uncertainty lingers for some, however. “The equipment finance and leasing marketplace has always been resilient and performs well in market dislocation,” Dave Fate, president and CEO, Stonebriar Commercial Finance, commented, adding, “I have concerns around the unknown impact of numerous executive orders, as well as COVID-19.”

Overall, when asking respondents to assess conditions over the next four months, the survey found:

- 46.2% of executives said they believe business conditions will improve, up from 33.3% in January; 46.2% believe business conditions will remain the same, a decrease from 59.3% the previous month; and 7.7% believe business conditions will worsen, a slight increase from 7.4% in January.

- 42.3% believe demand for leases and loans to fund capital expenditures (capex) will increase, up from 33.3% in January; 53.9% believe demand will “remain the same”, a decrease from 59.3% the previous month; and 3.9% believe demand will decline, down from 7.4% in January.

- 23.1% expect more access to capital to fund equipment acquisitions, up from 18.5% in January; 76.9% of executives indicate they expect the “same” access to capital to fund business, a decrease from 81.5% last month; and none expect “less” access to capital, unchanged from the previous month.

- 38.5% report they expect to hire more employees, up from 25.9% in January; 61.5% expect no change in headcount, a decrease from 66.7% last month; and none expect to hire fewer employees, down from 7.4% in January.

When asking respondents to assess economic conditions over the next six months, the survey found:

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from the previous month; 76.9% of the leadership evaluate the current U.S. economy as “fair,” down from 77.8% in January; and 23.1% evaluate it as “poor,” up from 22.2% last month.

- 50% believe that U.S. economic conditions will get “better” over the next six months, a decrease from 51.9% in January; 38.5% believe the U.S. economy will “stay the same”, an increase from 37% last month; and 11.5% believe economic conditions in the U.S. will worsen, up slightly from 11.1% the previous month.

- 30.8% of respondents indicate they believe their company will increase spending on business development activities, an increase from 22.2% last month; 69.2% believe there will be “no change” in business development spending, a decrease from 74.1% in January; and none believe there will be a decrease in spending, down from 3.7% last month.

Information provided by the Equipment Leasing & Finance Foundation and edited by Becky Schultz.