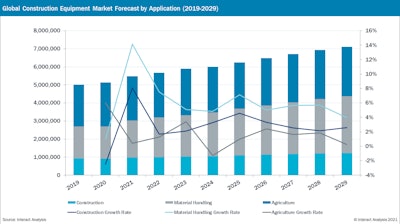

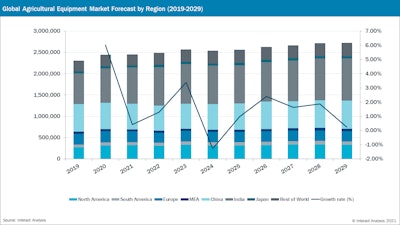

Not surprisingly, the pandemic proved unkind to off-highway equipment sales in 2020, with global market growth slowing to 2.6% for the year. Construction equipment sales were hit particularly hard in most regions due to the closure of construction sites and cancellation of events to control the spread of the coronavirus. However, with a global recovery underway, a new study, The Off-Highway Vehicles Market by Interact Analysis, projects 6.5% growth in overall off-highway equipment sales in 2021, with a CAGR of 3.65% in unit shipment terms expected between 2019 and 2029.

Interact Analysis is an international provider of market research for the Intelligent Automation sector. The research for its report was conducted during the period from September 2020 to February 2021, and included multiple interviews with stakeholders in the off-highway vehicle industry, including manufacturers, vendors and end users.

The report indicates the closure of construction jobsites and event cancellations affected growth rates in the first half of 2020 in most global regions. China was the only major region to buck the sustained downward trend, with most of its construction and manufacturing activities recovered to a normal level as early as May. For example, China reported 37% growth in excavator sales and 40% growth in telehandlers for the year.

Both the construction equipment and agricultural machinery sectors are expected to continue to gain momentum in 2021. Global sales of construction equipment had already begun to recover in the second half of 2020, and farm machinery is projected to continue to see long-term gains as the rate of mechanization increases in developing markets. In addition, the overall volume of material-handling equipment sales – another sector studied in the report – are expected to surpass even that of agricultural equipment from 2025 onward as online shopping, e-commerce and warehouse automation spur the demand for light equipment such as forklift trucks. This has led the report’s analysts to predict a 6.5% recovery for the whole off-highway vehicle sector in 2021, with an annual average growth rate of 3.65% in overall equipment shipments for the 10-year period from 2019 to 2029.

Electric Power to See Sustained Growth

Interact Analysis predicts more than 36% of off-highway vehicle shipments will be electric powered. However, Alastair Hayfield, senior research director, goes on to note, “While we predict that over 36% of shipments of off-highway vehicles will be electrified equipment by 2029, the overwhelming majority of these will be smaller vehicles where battery technology is more suitable. Electrification of compact construction vehicles offers many benefits – minimizing emissions and noise levels, allowing the equipment to be used in enclosed environments such as inside buildings and in other noise-sensitive areas.”

Electrification will be slower to emerge in the agricultural sector. “Electric tractors may make inroads in some agricultural scenarios,” Hayfield comments. “But agriculture faces other challenges on the pollution front, such as enteric fermentation – the production of methane by farm livestock – next to which pollution from diesel-powered machinery pales into insignificance.”

Material-handling equipment is anticipated to make up the largest segment of electric-powered units. "For many of the environments where material handling typically works, such as airports and logistics centers, there is already a high demand for ‘greener’ equipment," Hayfield points out. "These places will continue to adopt electrification very aggressively."

Information provided by Interact Analysis and edited by Becky Schultz.