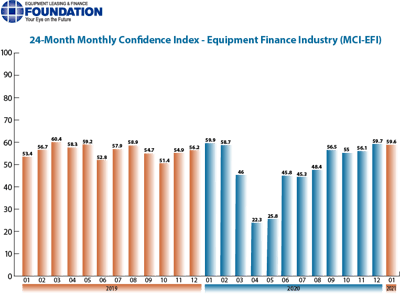

The January 2021 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) reports confidence in the equipment finance market is unchanged from the December index at 59.6 and in line with pre-pandemic levels. Yet, there was a notable uptick in optimism for the business conditions outlook over the next four months.

“As we enter a new year and a new administration, eyes will be on fiscal policy to get us through the final stretches of the pandemic,” noted survey respondent Michal Romanowski, president, Farm Credit Leasing, when asked about the outlook for the future. “We expect business investment to increase once the path forward is clearer.”

The MCI-EFI, released by the Equipment Leasing & Finance Foundation, reports a qualitative assessment of the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Respondents are comprised of a wide cross-section of industry executives, including large-ticket, middle-market and small-ticket banks, independents and captive equipment finance companies.

When asked to assess their business conditions over the next four months, 33.3% of executives responding said they believe business conditions will improve, up from 27.6% in December; 59.3% believe conditions will remain the same, a decrease from 62.1% the previous month; and 7.4% believe conditions will worsen, a decrease from 10.3% in December.

Looking at the outlook over the next four months:

- 33.3% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase, up from 27.6% in December; 59.3% believe it will “remain the same” during the period, an increase from 55.2% the previous month; and 7.4% believe demand will decline, down from 17.2% in December.

- 18.5% of the respondents expect more access to capital to fund equipment acquisitions, down from 24.1% in December; 81.5% of executives indicate they expect the “same” access to capital to fund business, an increase from 75.9% last month; and none expect “less” access to capital, unchanged from the previous month.

- 25.9% of the executives report they expect to hire more employees, down from 31% in December; 66.7% expect no change in headcount, a decrease from 69% last month; and 7.4% expect to hire fewer employees, up from none in December.

None of the leadership surveyed evaluated the current U.S. economy as “excellent,” which is unchanged from the December. However, 77.8% of the leadership evaluated the current U.S. economy as “fair,” up from 72.4% in the previous month, and 22.2% evaluate it as “poor,” down from 27.6% last month.

Looking at their outlook over the next six months:

- 51.9% of the survey respondents believe that U.S. economic conditions will get “better”, a decrease from 55.2% in December; 37% indicate they believe the U.S. economy will “stay the same”, an increase from 34.5% last month; and 11.1% believe economic conditions in the U.S. will worsen, up from 10.3% the previous month.

- 22.2% of respondents indicate they believe their company will increase spending on business development activities, a decrease from 34.5% last month; 74.1% believe there will be “no change” in business development spending, an increase from 62.1% in December; 3.7% believe there will be a decrease in spending, up slightly from 3.5% last month.

The COVID-19 Impact Survey of the Equipment Finance Industry, conducted monthly since its launch in May 2020 and released with the MCI-EFI, will be reported on a quarterly basis in 2021. Questions will be revised to reflect longer term effects of the pandemic’s impact on equipment finance companies going forward.