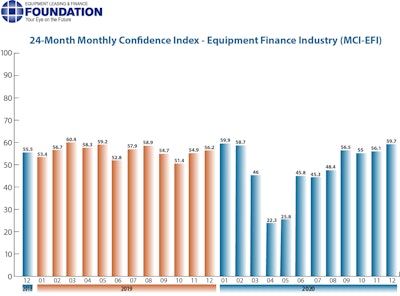

The Equipment Leasing & Finance Foundation’s December 2020 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) showed overall confidence in the equipment finance market is 59.7, an increase from the November index of 56.1. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector.

When asked about the outlook for the future, MCI-EFI survey respondent Paul Tyczkowski, senior vice president finance, LEAF Commercial Capital Inc., said, “While the COVID crisis continues to have significant impacts on businesses as we close out the year, there’s reason for cautious optimism now that the distribution of a highly effective vaccine is underway. Assuming distribution occurs as planned, I’m hopeful for a steady return to at least some level of normalcy in our lives and the economy during 2021.”

“The end to the pandemic is in sight, so while we need to navigate the next few months carefully, FY 2021 will undoubtedly improve as the year progresses,” added Bruce J. Winter, President, FSG Capital, Inc.

December 2020 Survey Results

When asked to assess their business conditions over the next four months:

- 27.6% of executives responding said they believe business conditions will improve, up from 26.9% in November; 62.1% believe business conditions will remain the same, an increase from 53.9% the previous month; 10.3% believe business conditions will worsen, a decrease from 19.2% in November

- 27.6% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase, up from 19.2% in November; 55.2% believe demand will “remain the same”, a decrease from 69.2% the previous month; 17.2% believe demand will decline, up from 11.5% in November

- 24.1% of the respondents expect more access to capital to fund equipment acquisitions, up from 23.1% in November; 75.9% of executives indicate they expect the “same” access to capital to fund business, a decrease from 76.9% last month; none expect “less” access to capital, unchanged from the previous month

- 31% of the executives report they expect to hire more employees, up from 30.8% in November; 69% expect no change in headcount, an increase from 57.7% last month; none expect to hire fewer employees, down from 11.5% in November

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from the previous month; 72.4 evaluate the current U.S. economy as “fair,” down from 76.9% in November; 27.6% evaluate it as “poor,” up from 23.1% last month

Over the next six months:

- 55.2% of the survey respondents believe that U.S. economic conditions will get “better, an increase from 34.6% in November; 34.5% indicate they believe the U.S. economy will “stay the same”, a decrease from 50% last month; 10.3% believe economic conditions in the U.S. will worsen, down from 15.4% the previous month

- 34.5 % of respondents indicate they believe their company will increase spending on business development activities, an increase from 26.9% last month; 62.1% believe there will be “no change” in business development spending, a decrease from 69.2% in October; 3.5% believe there will be a decrease in spending, relatively unchanged from 3.9% last month

COVID-19 Impact Survey

The foundation also released highlights of the COVID-19 Impact Survey of the Equipment Finance Industry, a monthly survey of industry leaders designed to track the impact of the coronavirus pandemic on the equipment finance industry. Forty-seven survey responses were collected from December 1 to 14 on a range of topics, including payments deferrals, defaults and staff analysis.

Results indicate:

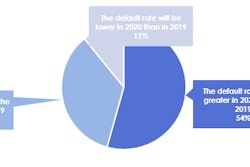

- 50% of companies expect that the default rate will be greater in 2020 than in 2019, down from 54% in November; 33% expect it to be the same, down from 35% last month; and 17% expect it to be lower compared to 11% last month

- Only 2% of lenders reported having more than 10% of their portfolio now under deferral, down from 4% of lenders last month

- 64% have 0.01% to 4.99% of dollars outstanding currently under payment deferral in their owned portfolio.

Comments from survey respondents were mixed. Jonathan Ruga, CEO, Sentry Financial Corporation, noted, “Through 2021, the economic climate will be tepid in many sectors and robust in a few. The medium term will show a significant uptick in volume, particularly in the construction and ancillary industries. With the political strife, social justice issues, U.S. debt load and global competition, the long term is uncertain at best.”

Donna Yanuzzi, managing director of sales and marketing, F.N.B. Equipment Finance, was a bit more optimistic. “There’s quite a bit of pent-up demand due to COVID,” she indicated. “Mid-2021, we should see a large increase in equipment purchases in all verticals. As long as there is equipment to purchase there will always be equipment finance needs.”

Vincent Belcastro, group head syndications, Element Fleet Management, believed, “Given the rising COVID rates, I would expect a temporary slowdown in activity in the short term. Medium term and, depending on monetary and tax policy with the new Biden administration, could exhibit a downturn and short recession. I believe in the long term our industry will be strong with new technological and alternative asset types driving demand.”

Additional survey results and analysis are available at https://www.leasefoundation.org/industry-resources/covid-impact-survey/.

Information provided by the Equipment Leasing & Finance Foundation and substantially edited by Becky Schultz.