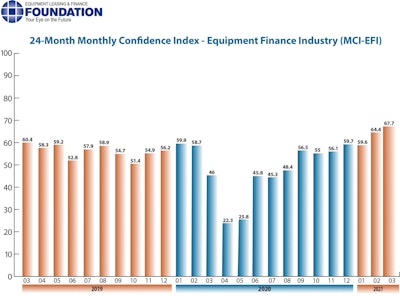

Overall, confidence in the equipment finance market reached its highest level in three years, with half of the key industry executives who responded to the Equipment Leasing & Finance Foundation’s March 2021 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) forecasting business conditions to improve over the next four months as economic activity expands. This should mean greater financing availability for those seeking to invest in their business.

The MCI-EFI reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. It shows confidence in the equipment finance market rose from 64.4 in February to 67.7 in March, the highest level seen since April 2018.

Expanding availability of COVID-19 vaccines plays a substantial role in growing confidence levels. “The vaccine rollout is now progressing quickly, and while some predict we won't see the end of this pandemic until year end, I believe everyone that wants a vaccine will be able to receive one by early May,” projected survey respondent Bruce J. Winter, president, FSG Capital, Inc. “This bodes well for the return of strong economic activity that will almost certainly boost capital spending significantly.”

“As COVID restrictions lift and companies have a clearer vision of future demand, it will help companies make more informed capex decisions,” added Vincent Belcastro, group head syndications, Element Fleet Management.

Lenders are increasingly upbeat about financing activity for the year and going forward, though cautions remain. “We are relatively positive on domestic and global economic activity for this year, and likely next,” noted David Drury, senior vice president and head of equipment finance, Fifth Third Bank. “Despite lingering disruptions, with the tailwinds of government stimulus, central bank liquidity, excess capacity and pent-up demand, global economic growth may positively surprise in 2021.

“The big question that could change our mind would be a return of inflation, which would change the dovish nature of most global central banks,” he continued. “Higher inflation would lead to higher interest rates and less of an incentive for businesses to borrow and invest.”

March 2021 Survey Results

When asked to assess conditions over the next four months:

- 50% of executives responding said they believe business conditions will improve, up from 46.2% in February; 46.4% believe business conditions will remain the same over the next four months, unchanged from the previous month and 3.6% believe business conditions will worsen, a decrease from 7.7% in February.

- 42.9% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase; 53.6% believe demand will “remain the same”; and 3.6% believe demand will decline, all relatively unchanged from February.

- 28.6% of respondents expect more access to capital to fund equipment acquisitions, up from 23.1% in February; 71.4% of executives indicate they expect the “same” access to capital to fund business, a decrease from 76.9% last month; none expect “less” access to capital, unchanged from the previous month.

- 42.9% of the executives report they expect to hire more employees, up from 38.5% in February; 57.1% expect no change in headcount, a decrease from 61.5% last month; none expect to hire fewer employees, unchanged from February.

Of those surveyed, 3.6% of the leadership rate the current U.S. economy as “excellent,” an increase from none the previous month. More than three-quarters (78.6%) evaluate the current U.S. economy as “fair,” up from 76.9% in February, while 17.9% evaluate it as “poor,” down from 23.1% last month.

When asked about the outlook for the next six months:

- 60.7% of survey respondents believe U.S. economic conditions will get “better”, an increase from 50% in February; 32.1% indicate they believe the economy will “stay the same”, a decrease from 38.5% last month; and 7.1% believe economic conditions in the U.S. will worsen, down from 11.5% the previous month.

- 39.3% of respondents indicate they believe their company will increase spending on business development activities, up from 30.8% last month; 60.7% believe there will be “no change” in business development spending, a decrease from 69.2% in February; and none believe there will be a decrease in spending, unchanged from last month.

Information provided by the Equipment Leasing & Finance Foundation and edited by Becky Schultz.