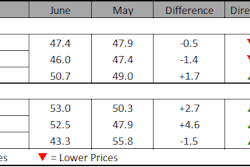

Construction costs rose for the 35th consecutive month in December, according to IHS (NYSE: IHS) and the Procurement Executives Group (PEG). The headline current IHS PEG Engineering and Construction Cost Index (ECCI) eased further to 52.7 percent in December, down from 53.0 percent in November and near 2014 lows.

The current materials/equipment price index registered 50.2 percent in December, the lowest reading since June 2013, and just a touch above flat prices. Half of the individual components registered neutral prices in December. Of the remaining subcomponents, falling freight rates offset strength in fabricated structural steel and ready mix concrete. The reading in December continues a three month trend of easing price pressures.

Tightness in Skilled Labor Markets a Constant Theme

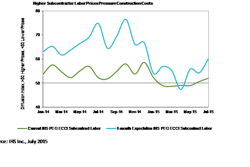

The current subcontractor labor index strengthened to 58.6 percent in December from 53.8 percent in November. The U.S. South continues to experience the highest readings of any region. As has been the consistent message over the course of 2014, respondents again reported tightness in skilled labor markets in the Gulf Coast and Alberta regions – specifically referencing qualified welders and pipefitters.

The six month headline expectations index eased to 60.9 in December from 63.1 percent in November. Although still positive, the materials/equipment index sunk to the lowest reading on record. While the majority of subcomponents continue to register stronger prices, it is of note that expectations for both freight rates and copper-based wire and cable were below the neutral mark. Meanwhile, expectations for subcontractor labor registered 66.8 percent in December, a touch higher than the November reading, with the regional detail continuing to convey strong expectations in the US South.

Downbeat December Reading Masks 2014 Performance

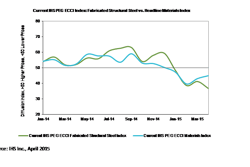

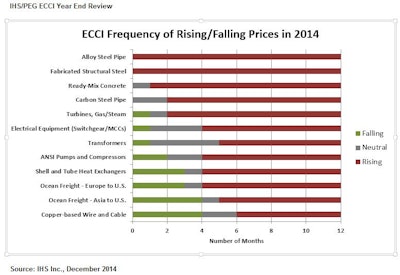

Despite ending 2014 on a restrained note, over the course of the year, respondents to the IHS PEG Engineering and Construction Cost Index (ECCI) were considerably more bullish on current materials/equipment than in years past. Steel-related products proved to be at the heart of the price climate this past year.

On a monthly basis, alloy steel pipe saw the highest reading of any component for seven months during 2014. This trend was driven in part by the nickel environment, which was boosted early in the year by the combination of Indonesia’s export ban and tensions between Russia and the west, said John Mothersole, research director of the pricing and purchasing service for IHS.

“Prices for alloyed steel pipe and fabricated structural steel stayed stubbornly high throughout the year, with ready-mix concrete being another source of pricing strength,” Mothersole said. “On the flip side, copper-based wire and cable saw the highest frequency of falling prices of any component in 2014, driven largely by concerns over Chinese growth and a market surplus.”

ECCI

The IHS PEG Engineering and Construction Cost Index (ECCI) is based on data independently obtained and compiled by IHS from the procurement executives of leading engineering, procurement and construction firms. The headline index tracks industry-specific trends and variations, identifying market-turning points for key projects, and is intended to act as a leading indicator for wage and material inflation specific to this industry.

Each survey response is weighted equally for every $2 billion in spending in North America. Respondents are asked whether prices — either actual paid transactions or company-informed transactions—during the current month for individual materials, equipment, and regional subcontractor rates, were higher, lower or the same as the prior month.

Respondents are then asked for their six-month pricing expectations among these same subcategories. The results are compiled into diffusion indexes, in which a reading greater than 50 represents upward pricing strength and a reading below 50 represents downward pricing strength.

To learn more about the new IHS PEG Engineering and Construction Cost Index or to obtain the latest published insight, please visit: www.ihs.com/ecci