Segments in both residential and nonresidential are showing potential for growth, according to industry economists who participated in a spring economic webcast on April 30.

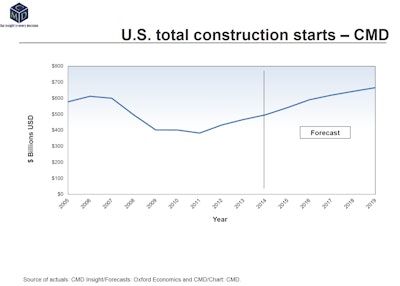

According to Alex Carrick, chief economist at CMD, total construction dollar starts for 2015 is good but has room to improve. Carrick predicts a 9 percent improvement in construction dollars in both 2015 and 2016.

On the residential side, Carrick indicated that the multifamily sector has fully recovered from the downturn while the single-family market is still only about half of its norm. He estimates that the construction industry would have 600,000 to 700,000 more jobs if the single-family market was back to normal levels.

Overall housing starts have been up and down in recent quarters but should see continued improvement and growth, according to Kermit Baker, chief economist at the American Institute of Architects. Baker says housing starts are expected to be up 18 percent in 2015 and another almost 20 percent in 2016. Even with these double digit growths housing starts are still years away from returning to historical levels.

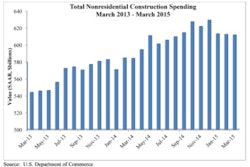

On the nonresidential side, economist agree that there are a few areas set for growth in 2015. According to Associated General Contractors Chief Economist Ken Simonson, the nonresidential sector as a whole should see around 7 percent growth in 2015, which is identical to what the sector recorded in 2014. AGC predicts both the power and manufacturing subsections should experience double digit growth this year.

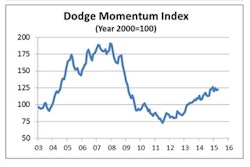

New Construction Project Inquiries Show Healthy Gain in March

Carrick said hotel/motel starts should show also some real growth in 2015, and Baker added the commercial sector should see strong gains thanks in part to increasing property values. According to Baker, commercial properties were not nearly as overvalued as house prices so recovery for commercial property values has been a bit easier.

Institutional construction should finally see a recovery in 2015, although most of this will be school buildings for the lower grades, Carrick predicted.

Carrick expects office construction to be one possible bright spot in 2015, but Simonson said more money may go into renovating existing office buildings rather than building new buildings.

US Office Construction Highest Since 2009

Several trends could have a positive effect on the construction industry in 2015 and the future:

- Energy extraction

- High tech

- Tidewater ports (as a result of the Panama Canal Expansion)

- Live-work and mixed-use construction projects

- "Shale Gale"

- Residential revival (particularly multifamily)

According to Carrick, mixed-use projects are the biggest trend in nonresidential construction right now. This is driven by both young adults and seniors looking for downtown living and the amenities and benefits that come with living near commercial, office, retail and restaurants.

The three economists also agreed that the expansion of the Panama Canal would have an impact on U.S. ports. At least five ports in the U.S. will see "mega investment," according to Carrick.

Construction of the new Expanded Panama Canal

While there are areas of positivity, there are also areas of concern. Baker pointed out that energy prices, interest rates and the labor market are all wildcards that could have either a positive or negative effect on the construction economy.

Simonson added that a lack of government spending, employers shrinking office space per employee and consumers switching to online buying are three current trends that are holding the construction economy down.