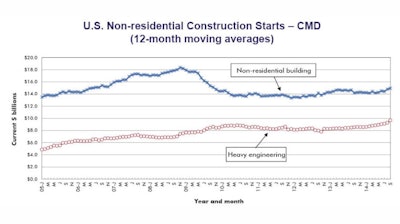

September’s month-to-month change was a mild retreat after August’s 25 percent increase. The dollar volume of starts in the standalone month of September, at $27.7 billion, was the third highest this year. It was exceeded only by June and August, both at $32 billion.

When compared with the same month of last year, September 2014 stepped up by almost one-third (+30.4 percent). Year-to-date starts, with only the final quarter still to go, are ahead by 10.5 percent versus the first nine months of 2013.

The starts figures are in “current” dollars, meaning they are not adjusted for inflation.

“Nonresidential building” plus “engineering/civil” work accounts for a considerably larger share of total construction than residential activity. The former’s combined proportion of total put-in-place construction in the Census Bureau’s August report was 62 percent versus the latter’s 38 percent.

CMD’s construction starts are leading indicators for the Census Bureau’s capital investment or put-in-place series.

Stock markets may have turned skittish of late, due to Europe’s economic standstill and worries about military “hot spots” in the Middle East, but many of the fundamentals for the U.S. economy have been growing stronger.

Weekly initial jobless claims have averaged less than 300,000 for the past three months, which is bullish for employment gains. The total number of jobs has risen by 227,000 month-to-month, on average, so far this year, dropping the unemployment rate to 5.9 percent, a post-recession low.

The jobless rate in construction has also declined, to 7 percent this September from 7.7 percent in August and from 8.5 percent in September 2013.

Among the three major construction subcategories, only heavy engineering starts (+4.4 percent) recorded a month-to-month increase in September. Institutional (-18.2 percent) and commercial work (-22.1 percent) were down to almost the same degree.

The smaller category of industrial starts continued its pattern of extreme swings. After increasing nearly 1,000 percent in August, thanks to a limited number of mega-sized project initiations, it plummeted (-98.2 percent) back to earth in September.

When this September’s figures are compared with the same month of last year, the story is quite different. Engineering/civil starts (+54.8 percent) were up by more than half. While somewhat more restrained, commercial (+18 percent) and institutional (+16 percent) were still ahead nicely. Only industrial (-92.6 percent) had a sad tale to tell.

In year-to-date starts, engineering/civil work (+17.5 percent) is the frontrunner, with institutional (+8.6 percent) jogging forward at about half its speed. Commercial (+2 percent) is little more than stalled. Year-to-date industrial starts (+22.8 percent) are up by between one-fifth and one-quarter.

The origins of engineering/civil work’s September uptick were the water and sewage subcategory (+30.7 percent month over month; +45.4 percent year over year; and +15.3 percent year to date) and bridges (+28 percent m/m; +26.2 percent y/y; and +1.7 percent ytd). Road and highway starts were uninspiring (-0.8 percent m/m; but +76.1 percent y/y; and+17.6 percent ytd).

Institutional starts were pulled down in the latest month by the school/college subcategory (-29.7 percent m/m; but +3.5 percent y/y; and +8.4 percent ytd). Hospital/clinic starts were more upbeat (+42 percent m/m; +27.3 percent y/y; but -9.1 percent ytd). The year-to-date dollar volume in the school/college subcategory is approximately four times as great as in hospitals/clinics.

Commercial’s September weakness was centered in the hotel/motel (-61.6 percent m/m), parking garage (-53 percent m/m) and catch-all “miscellaneous” (-81.4 percent) categories. There was better news in retail (+22.9 percent m/m; but -0.2 percent y/y; and -7.5 percent ytd), private office buildings (+68.3 percent m/m; -27.1 percent y/y; and +4.3 percent ytd) and government office buildings (+12.7 percent m/m; +16.7 percent y/y; and +9.9 percent ytd).

Also providing recent pick-me-ups within commercial work were the amusement (+81.1 percent m/m; +155.1 percent y/y; and +24.6 percent ytd) and warehouse (+13.7 percent m/m; +190.5 percent y/y; and +83.1 percent ytd) categories.

According to the Department of Labor’s most recent Employment Situation report, the total number of jobs in the U.S. rose 1.9 percent year-over-year in September. Payrolls in construction (+3.9 percent) climbed slightly more than twice as fast.

The increase in architectural and engineering services employment, at 4.5 percent, was a further impressive notch higher. Along the construction pipeline, the “drawing board” stage is in advance of both starts and the hiring of more on-site workers.

The value of construction starts each month is summarized from CMD’s database of all active construction projects in the U.S. Missing project values are estimated with the help of RSMeans’ building cost models.

CMD’s nonresidential construction starts series, because it is comprised of total-value estimates for individual projects, some of which are quite large, has a history of being more volatile than many other leading indicators for the economy.

A start is determined by taking the announced bid date and adding 30 days. It is then assumed the project will break ground within 30 to 60 days of the start date. Reed continues to follow the project via its network of researchers. If it is abandoned or re-bid, the start date is updated to reflect the new information.