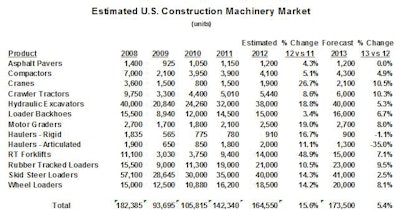

The 2012 equipment market benefited greatly from re-fleeting by rental companies and dealer rental fleets. Overall equipment unit sales grew 15.6 percent, with most of that growth in the first half.

Equipment-industry consultant Frank Manfredi estimates rental companies consumed approximately 22 percent of new machinery sold and that dealers that operate rental fleets consumed 23 percent of new equipment sold. Third-party rental companies consumed another 7 percent. That totals 52 percent of all equipment purchased in the U.S. going to rental fleets. United Rentals alone purchase more than $1.3 billion of new equipment.

It appears that most rental companies shifted their fleet profile toward earthmoving equipment. Fleet spending levels of rental companies for products such as skid steer loaders, rubber tracked loaders, compact excavators and small wheel loaders were up 10 to 14 percent year-over-year from 2011 to 2012.The rough terrain forklift market was up nearly 49 percent. This category includes telescopic boom forklifts.

Manfredi also estimates the crane market grew 26.7 percent driven by aggressive buying by crane rental companies.