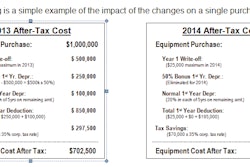

As most construction professionals are aware, the special tax deduction for equipment purchases under Section 179 expired at the beginning of 2014. This tax code allowed construction companies to take advantage of a $500,000 deduction as well as bonus depreciation on purchases of new and used equipment. While a lower $25,000 deduction was reinstated in 2013, this amount does not significantly help construction companies, which typically have multimillion dollar equipment needs.

To date the $500,000 deduction has yet to be reinstated, and is currently stalled, awaiting Senate approval.

With so much money on the line for construction companies that have already purchased equipment in 2014, as well as those that need to purchase equipment before the end of year, this is simply not the time for our representatives to sit idly by as the clock runs out.

What is Section 179 and Bonus Depreciation?

This special allowance enables businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year from their gross income. This tax code allowed companies purchasing heavy equipment for their businesses to write off a significant portion of the purchase as well as the depreciated value, all in the same year in which they bought the equipment.

The most recent version of the tax deduction allowed for a deduction limit of up to $500,000 on new and used equipment, as well as off-the-shelf software up to $2 million. In addition, the tax code allowed for a 50% bonus depreciation to be taken the first year on new equipment purchases. This deduction is taken after the $2 million limit for capital equipment purchases is reached.

Clearly a tremendous tax incentive for many construction business owners, Section 179 allowed companies to often write off almost the entire cost of new equipment purchases. Construction companies were then free to grow their businesses, and hire the employees they needed as the industry worked to bounce back from the recession.

Take action

The tax boost Section 179 and Bonus Depreciation provided was invaluable for business owners. With the end of the year rapidly approaching, the window of time for this initiative to be reinstated continues to shrink. Without Section 179, many companies will find themselves stagnant in the coming year.

What’s interesting is that both Democrats and Republicans are actually in agreement that this code should be reinstated, both retroactively for 2014, and for 2015. The only parts of this tax code on which they do not agree are, A) how many years it should be reinstated for, and B) how the government will pay for the tax break. Republicans believe the code should be reenacted indefinitely, while Democrats, who are worried about the implications the bill will have on the deficit, would like to see it reinstated only through 2016.

What you should tell your representatives

- Talk to your representatives about unemployment:

For many construction companies, the money they were able to save in taxes under Section 179 was spent hiring new employees. In that sense, Section 179 is a job creator. Even though the economy has improved, construction businesses today still need an extra push in order to return to prerecession volume. With unemployment rates still high across the country this program not only helps individual businesses, but it helps the economy as a whole.

- Tell to your representatives about how this will help your business grow:

In past years, Section 179 has not only enabled business to hire new employees, which has helped the economy, but it has also provided tremendous assistance for the businesses themselves. The construction industry was hit particularly hard by the recession, and the section 179 and bonus depreciation tax code helped to sustain many businesses during that time. Today, the program will continue to support those companies as they begin to grow once more. Across the board, this program helps small to medium-sized businesses, as well as the disappearing middle class, in which the majority of construction workers fall.

- Tell your representatives to forego political games and focus on the needs of constituents:

Considering both sides of the political spectrum agree that this is an excellent piece of legislation that should be reinstated, political motives appear to be the only thing getting in the way. Let your representatives know that stalling this vote is not helpful to the construction companies or to the economy as a whole, and ask them to focus on helping those they represent. Whether reinstated for two years or 20, the House and Senate need to move this bill forward before the end of the year, or businesses will lose billions of dollars in tax breaks.

The bottom line is that construction company owners cannot afford to wait for this legislation to pass. With November well underway, there is little time left to get this initiative through the Senate and have it actually impact American businesses this year.

Individuals and company owners alike should write or call their House and Senate representatives today to stress the importance of this bill and what it means to their business.

To find specific representatives, based on zip code business owners and individuals can use this tool: http://www.opencongress.org/people/zipcodelookup

Eric Freeman is Vice President of Summit Funding Group, an Ohio-based company that provides equipment lease and finance solutions to businesses across the U.S. and Canada. Founded in 1993, Summit Funding Group has originated more than $2 billion in equipment lease and finance transactions to date. Freeman has more than 12 years of experience in equipment finance and has completed billions of dollars in financing transactions throughout his career. Contact him at [email protected]