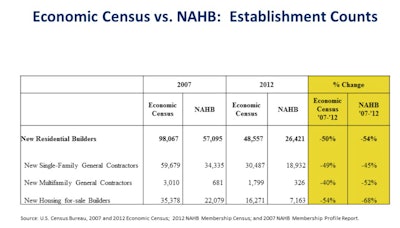

Results for the residential construction industry economic census for 2012 were recently released, and according to this official count, the number of establishments whose primary activity is new residential construction fell from 98,067 in 2007 to 48,557 in 2012, a dramatic 50% decline. The latest tally is the lowest number of builders reported by the Economic Census since 1997, the first time builders were reported separately from remodelers.

National Association of Home Builders' (NAHB) records, meanwhile, show builder membership (single-family and multifamily) falling from 57,095 in 2007 to 26,421 in 2012 — a 54% drop. The similar contractions experienced by the overall industry (50%) and NAHB (54%) during this five-year period demonstrate that NAHB’s loss of builder members was a mere reflection of the overall disappearance of new residential builders from the American economy.

It is important to note, however, that the slightly higher decline of NAHB’s membership is largely due to the fact that our members can have multiple memberships in multiple local associations, and therefore the loss of one establishment for the Economic Census can mean the loss of multiple membership records for NAHB.

The Economic Census breaks down the aggregate number of builders in the country into three distinct types of builders:

- New single-family general contractors: establishments primarily responsible for the entire construction of new single-family housing (land is not included in sale).

- New multifamily general contractors: establishments primarily responsible for the construction of new multifamily residential housing units (not on their own account).

- New for-sale builders: establishments primarily engaged in building new homes on land that is owned or controlled by the builder rather than the homebuyer or investor. The land is included with the sale of the home. Establishments in this industry build single and/or multifamily homes.

All three types of builders saw their numbers decline from 2007 to 2012. New housing for-sale builders declined by 54%, new single-family general contractors by 49% and new multifamily general contractors by 40%. Following along the same lines, NAHB’s losses were 68%, 45% and 52%, respectively.

One plausible explanation for why spec builders (new for-sale builders) suffered the heaviest losses is that the housing recession caught them with significant land inventory positions they were unable to unload profitably, and as a result, went out of business. Because these larger spec builders are the most likely to have multiple NAHB memberships, their withdrawal from the industry had a greater impact on our tally than that of the Economic Census.

This data not only confirm the disappearance of home building companies in recent years, but it also provide evidence that any future growth in NAHB’s builder membership will hang on the (re)birth of new residential building companies.