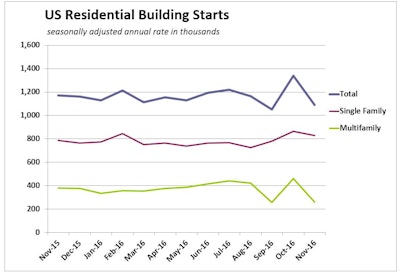

Housing starts tumbled 18.7% in November, which was more than consensus forecasts, to a 1.09 million seasonally adjusted annual rate after a 1.34 million rate in October. Housing-construction permits fared better, falling 4.7% to a seasonally adjusted annual rate of 1,201,000 units (now 6.6% below November 2015 permits).

Much of the volatility in starts has been in the multifamily sector, which saw starts surge 76% in October and fall back 45.1 percent in November. The past three months have been unusually volatile for multifamily starts. Permits have not fluctuated nearly as much.

“Unseasonably mild weather likely played a role in October’s stronger housing numbers and November’s apparent payback,” according to Wells Fargo Economics Group’s analysis of November housing-construction estimates by the U.S. Census Bureau. “The expectation of rising interest rates may have also been a factor in October’s surge in new construction. Apartment developers likely rushed to lock in financing before the presidential election and many home buyers likely signed purchase contracts and locked in mortgage rates ahead of the Fed’s widely anticipated hike in the federal funds rate that finally took place this past week.

“With demand pulled forward, starts were primed for a fall in November,” Wells Fargo suggests.

Comparing year-to-date actuals, total U.S. housing starts are running 4.8% ahead of their year-ago pace, while single-family starts are up 9.6 percent. Year-to-date multifamily starts are down 3.8 percent.

Midwestern housing stands out among otherwise declining construction in the other three regions that the Census Bureau records. Single-family starts surged 19.8% in the Midwest, where total starts year to date are 12.4% greater than the same period in 2015. Even in the West, where single-family starts plunged 15.3%, year-to-date starts are 7.6% ahead of the 2015 pace.

November Single Family Starts

|

Region |

Month Change |

November Starts* |

Year to Date* |

|

Midwest |

+19.8% |

145,000 |

+12.4% |

|

South |

-4.6% |

439,000 |

+9.5% |

|

Northeast |

-7.6% |

61,000 |

+10.9% |

|

West |

-15.3% |

183,000 |

+7.6% |

|

U.S. Total |

-4.1% |

828,000 |

+9.6% |

* November starts are seasonally adjusted annual rates. Change in year-to-date starts based on monthly actuals.

November’s bite was acute across all U.S. regions. Again, though, the Midwest stands out with a 68.8% November freefall that nonetheless leaves the region’s year-to-date multifamily production 24.5% ahead of 2015. Similarly, the West fell 30.3%, but remains 2.8% above last year on a year-to-date basis.

November Multifamily* Starts

|

Region |

Month Change |

November Starts* |

Year to Date* |

|

West |

-30.3% |

85,000 |

2.8% |

|

South |

-34.0% |

128,000 |

-2.7% |

|

Midwest |

-68.8% |

30,000 |

+24.5% |

|

Northeast |

-81.2% |

19,000 |

-29.7% |

|

U.S. Total |

-42.3% |

262,000 |

-3.8% |

* Multifamily starts here include any building that comprise two or more housing units. November starts are seasonally adjusted annual rates. Change in year-to-date starts based on monthly actuals.

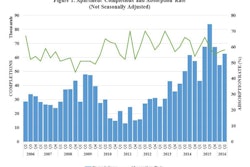

Wells Fargo correlates permits with their likely impact on starts to get a sense for what’s to come.

“Housing permits fell 4.7 percent in November to a still-solid 1.201-million unit pace,” according to Wells Fargo analysis. “Overall permits are running slightly below their trailing three-month average but are still 10.2 percent higher than starts. The entire gap is in multifamily units, where the three-month moving average of starts is running a staggering 72.4 percent below the three-month average of permits. Some rebound in multifamily starts is likely in coming months.

“Single-family starts are in the opposite position, with starts running ahead of permits, both for the month of November and on a three-month moving average basis. The net result is that single-family starts are likely to fall off in coming months, despite yesterday’s surge in homebuilder confidence.”