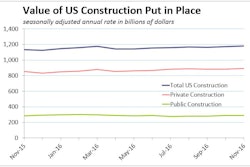

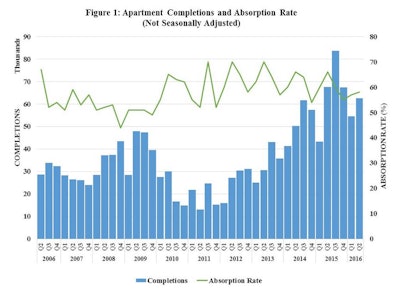

The U.S. Census Bureau recently released data on multifamily completions and absorption rates from the second quarter of 2016. Completions of privately financed, unfurnished, unsubsidized apartments in buildings with five or more units totaled 62,600, which is approximately 5,000 fewer than completions in the second quarter of 2015 (Figure 1).

The graph of completions and absorption rates also indicates a leveling off of multifamily completions from its peak in the third quarter of 2015 (completions in that quarter reached 84,000).

Multifamily starts, which also serves as a measure of multifamily market activity, have showed signs of slowing in 2016, compared to the prior year.

Census also reports on the absorption rate, or the share of these units that were rented within three months after completion. For apartments completed in the second quarter of 2016, the absorption rate stood at 58%, down 8% from the same quarter last year (66%).

Condominium (and cooperative) completions in the second quarter of 2016 totaled 2,800 units, essentially unchanged from the second quarter of 2015 (2,700 completions). However, the condominium absorption rate picked up slightly, going from 63% in the second quarter of 2015 to 66% in the second quarter of 2016 (Figure 2).

Subsidized and tax-credit-unit completions as a share of total apartment completions represented 7% (4,700 units) of total apartment completions in the second quarter of 2016. Starting in 2010, the share of these units completed surged, but started to decrease significantly starting in 2014 (Figure 3).