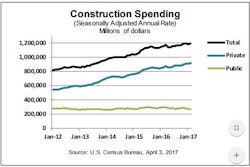

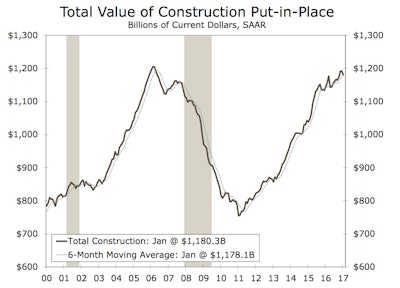

The total nominal value of construction put-in-place unexpectedly fell in January to a seasonally adjusted annual rate of $1,180.3 billion. With volatility in this monthly report par for the course, we rely heavily on the overall trend. The three-month moving average grew 0.2% during the month and is up 4.4% year over year, still indicating strength in the sector. On an inflation-adjusted basis (Index=2016), total outlays are up 0.5% relative to a year earlier, but are expected to rise 3.5% in 2017. The soft monthly reading was concentrated in the public component, which fell 5%, with state and local and federal both registering weak readings.

According to the U.S. Census Bureau, monthly state and local estimates have been largely weighed down by “retainage” reporting issues, when respondents record no expenditure value during the month but later pay the contractor the retainage once they receive sign off.

Private spending rises modestly

In contrast to the strong showing in new construction starts in January, private construction spending increased just 0.2% on the month but is up 7.3% year over year. Private residential construction spending rose 0.5%, with single-family and multifamily up during the month, while home improvements slipped.

Single-family outlays rose 1.1% during the month, marking the fourth straight increase. That said, we continue to expect improvement in single-family construction as the trend in new home sales activity continues to outpace outlays.

Private nonresidential outlays came flat in January, with fairly broad weakness across components with the exception of communication, power and manufacturing, which posted gains. With the help of construction on recently approved liquefied natural gas (LNG) export terminals, we continue to expect improvement during the year as the surge in natural gas production from shale plays positions the U.S. as a next exporter of LNG. Electric power and gas plant outlays were up more than 14% in January relative to a year earlier.

We are beginning to see outlays from the two large chemical plants started last year lift the headline: the $3 billion ethane cracker chemical plant in Lake Charles, LA, and the $1.4 billion ethylene plant in Plaquemine, LA. These projects are expected to be completed in 2018 and should buoy chemical manufacturing, which is the largest component in manufacturing construction spending. Chemical manufacturing rose 11.4% in January and is up 4.2% during the month.

Although outlays tumbled during the month a couple of notable projects started in January should help boost activity including the $3.4 billion Central Terminal Building at LaGuardia Airport, and the $477 million San Francisco International Airport project.