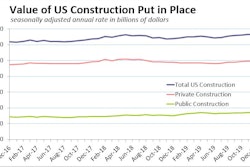

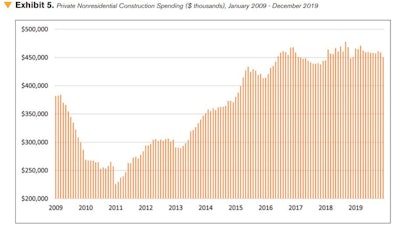

The Marcum Commercial Construction Index for the fourth quarter of 2019 reports healthy levels of construction spending in large part due to ongoing strength in infrastructure-related categories. Nonresidential construction spending stood at an annualized rate of $779.6 billion in December 2019, down 1.2% from the previous month but up 4.4% year-over-year.

The index is produced by Marcum’s National Construction Services group.

Eleven of the 16 nonresidential construction sectors expanded year-over-year, including massive upticks in publicly funded categories like water supply (+33.6%), conservation and development (+16.9%), highway and street (+14.1%), and public safety (+10.1%). Spending decreased from the same time last year in predominately privately funded categories like commercial (-4%), lodging (-3.9%), and amusement and recreation (-3%).

“The ongoing strength in infrastructure-related spending is a result of state and local finances being at their healthiest levels in quite some time as consumer spending, ongoing staffing expansions, and elevated assessed values drive tax collections higher,” wrote Anirban Basu, author of the report and Marcum’s chief construction economist.

Mr. Basu points to inflated property values as a possible explanation for stagnation in privately funded segments. “Investors and developers are becoming increasingly concerned that property values are speculatively high and that the pace of new project deliveries is outpacing the economy’s capacity to neatly absorb them,” he said.

Construction employment increased at a faster pace than the national nonfarm economy on both a monthly (+0.6%) and yearly (+1.9%) basis. Nonresidential specialty trade contractors added jobs at an impressive rate throughout 2019, while the nonresidential building category exhibited the slowest pace of growth of any of the construction subsegments.

Despite ongoing hiring, construction labor shortages remain problematic. “Throughout 2019, 4.2% of all available construction jobs were unfilled, the highest proportion on record. Between 2001 and 2015, the proportion of construction jobs that went unfilled was just 1.8%,” wrote Basu.

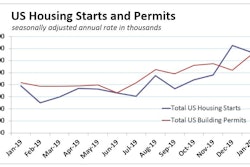

A reduction in trade-related uncertainty – the USMCA trade agreement was ratified, BREXIT is finally proceeding, and the U.S. and China have reached a phase I trade deal – along with a healthy residential sector and a labor market that exceeds expectations all represent economic tailwinds going into 2020.

Basu cites rising levels of debt across the economy, heightened political uncertainty as the November presidential election nears, and the effects of the coronavirus on world markets as tailwinds that could limit economic growth in 2020.