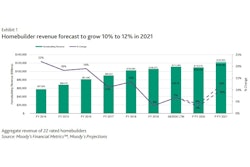

Newly published reports from Moody's Investors Service has raised the outlook for both the U.S. building materials sector and U.S. homebuilders to stable from negative as conditions for both sectors continue to show improvement, with favorable trends expected to continue over the next 12 to 18 months.

Building Materials Buoyed by Steady Demand

The outlook for the U.S. building materials sector has stabilized, the report on the sector indicates. After a brief halt in construction activities during the coronavirus pandemic, the rating agency expects the operating environment to remain steady over the next 12 to 18 months.

"Over the next year or so, we expect sequential improvement in economic activity, steady demand from the residential and public infrastructure end markets coupled with a low interest rate environment to keep activity and profitability in the building materials industry stable," said Moody's analyst Emile El Nems. "The improvement will be driven largely by a 2% increase in residential construction spending, partially offset by weakness in nonresidential spending."

Stay-at-home orders and the possibility of working from home over the longer term have created a need for more space, prompting families and young adults to leave urban centers in search of larger homes, El Nems says. Demand for new homes has soared creating supply demand imbalances after years of below-average housing starts and low inventories. Stable construction spending, along with low interest rates, should counteract the effects of high unemployment on the building materials sector.

Conversely, spending on the construction of office buildings and religious, lodging, educational and manufacturing facilities is set to fall by 10% in the second half of 2020. This decline should be partially offset by a 5% increase in spending for warehouses, data centers, 5G installations and public safety and healthcare facilities. At the same time, spending on public construction such as transportation networks will be fairly constant, driven by federal, state and local funding despite lower tax receipts.

Meanwhile, significant barriers to entry, limited competition and reasonable demand expectations mean the US building materials industry is set to enjoy long-term, sustainable pricing power, Moody's states. Restrictive environmental laws are deterring new entrants to the industry, as well as preventing substantial expansion by incumbents. However, with only eight firms controlling most of the volume and utilization rates at around 90%, competitors have little incentive to engage in irrational pricing behavior.

Fuel for Homebuilding Growth

As indicated, the improved outlook for US homebuilders is being fueled by a number of factors, including:

- expectations of solid demand activity due to increased emphasis on a home,

- supportive demographics,

- favorable affordability resulting from a combination of low interest rates and the continued shift of many homebuilders toward lower price product categories,

- and constrained inventory of available new and existing homes.

"As of July 2020, new home supply stood at four months, the lowest level seen in over seven years since January 2013," said Natalia Gluschuk, Vice President - Senior Analyst at Moody's. "Alongside low interest rates, which as of September 2020 were below 3% for the 30-year fixed-rate mortgage and expected to remain accommodative and support affordability conditions, the underlying fundamentals for the homebuilding industry are solid."

Among the trends buoying the homebuilding industry are the increased emphasis on a home and its non-monetary, intangible value as individuals began spending significantly more time in their dwellings amid the COVID-19 pandemic. Factors such as the safety features of a home, ability to socially distance, having extra space and a backyard, and remote work practice have all contributed to favorable demand trends amid the outbreak, according to Gluschuk. Furthermore, these trends are expected continue at a modest rate for years to come, including after the vaccine is found and risk of COVID-19 infection subsides.

Risk Factors

Nevertheless, Moody's cautions that there are a number of risks for the sector as the fallout from the coronavirus pandemic continues to play out. Chief among them is the stubbornly high unemployment rate. While forecast to fall slowly, it will prevent the homebuilding sector from growing significantly beyond the current robust resurgence in demand. The rating agency's analysts view this uptick as temporary as the pent-up demand from the first half of this year is released and the decision to purchase is accelerated by the circumstances created by the pandemic.

"Expiration of forbearance on mortgage payments for existing homeowners beginning in March/April of 2021 granted by the CARES Act, could result in increased mortgage delinquencies or defaults, and therefore lead to weakness in existing home prices and additional existing home supply in 2021," Gluschuk added.

Further risks include the trajectory of coronavirus infection rates and the effects these will have on the overall economy, consumer confidence and the demand for homes. Economic risk also includes the potential weakness in conditions of various industries following the cessation of stimulus funds.

Moody's Macroeconomic Board forecasts the unemployment rate in the U.S. of 8.9% by the end of 2020 and 7.6% by the end of 2021, improving gradually, but nevertheless remaining very high. The Board's GDP forecast also suggests a 5.7% decline in real GDP in the US in 2020, followed by a 4.5% US GDP growth in 2021. Accordingly, rating agency analysts expect relatively modest growth for the homebuilding sector in 2021, with a risk to the downside if unemployment fails to moderate or reverses.