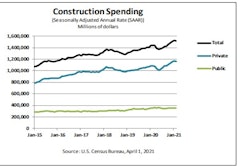

Continued strong demand for single-family housing, low housing inventory, steady infrastructure spending and continued low interest rates are all factors that will support strength in construction activity, says Moody’s Investors Service in its latest Building Materials report. It projects U.S. construction spending will grow 3.2% in 2021 and 3.4% in 2022, primarily driven by stable residential and public construction activity, as well as a nonresidential spending recovery.

Passage of a multiyear federal infrastructure investment bill would give a substantial boost to the longer-term outlook for construction activity, the report concludes.

“Whether it is President Joseph Biden’s ‘Build Back Better’ plan, or another proposal, we believe a multiyear federal infrastructure investment bill will boost U.S. construction spending growth… by about 200 basis points 9-12 months after being passed,” notes the report. “Assuming a bill is passed by Q3-2021, we project total U.S. construction spending ($1.5 trillion) to grow 5.0% in 2022 and 5.5% in 2023.”

Aggregate companies would be one of the beneficiaries of increased public infrastructure investment. Price and volume of aggregates is currently projected to increase by 3% per year. A sizable infrastructure bill could see price and volume increase an additional 2%. Cement and ready-mix producers are expected to see gains, as well.

Other building materials are expected to be affected to a lesser degree. Moody’s anticipates little impact on lumber pricing, which sees its largest demand from residential construction, and repair and remodeling activity. Steel and copper will see slightly more gains given increased focus on green initiatives, which are highly reliant on these metals.

Also bolstering demand and pricing will be the “Made in All of America” initiative, which commits to procuring steel, along with cement, concrete and other building products, from within the U.S.