Highlights

- Sales and revenues were $38.5 billion in 2016 – 18 percent decrease from 2015 and slightly lower than expected

- Period costs and variable manufacturing costs were $2.3 billion lower in 2016 – restructuring and cost reduction actions and lower incentive pay helped mitigate the impact of lower sales

- Restructuring costs and three large non-cash items in the fourth quarter impacted profit substantially – resulting in a loss for the quarter and the year

- Machinery, Engines & Transportation operating cash flow was $3.9 billion in 2016 – more than sufficient to cover capital expenditures and dividends

- 2017 sales and revenues are expected to be $36 billion to $39 billion with a midpoint of $37.5 billion – some signs of recovery, but risk and uncertainty continue

- At the midpoint of the sales and revenues range, 2017 profit per share is expected to be about $2.30 with adjusted profit of about $2.90 per share

Caterpillar Inc. (NYSE: CAT) today announced fourth-quarter and full-year results for 2016.

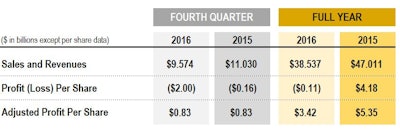

Sales and revenues in the fourth quarter of 2016 were $9.6 billion, down from $11.0 billion in the fourth quarter of 2015. Fourth-quarter 2016 was a loss of $2.00 per share, compared with a loss of $0.16 per share in the fourth quarter of 2015.

Full-year sales and revenues in 2016 were $38.5 billion, down about 18 percent from $47.0 billion in 2015. The company lost $0.11 per share in 2016, compared with a profit of $4.18 per share in 2015.

Fourth-quarter 2016 results included three large non-cash charges and higher than expected restructuring costs. These items resulted in a loss for the quarter and were the primary reason results were lower than the outlook provided in October 2016. A discussion of these items – mark-to-market losses for re-measurement of pension and OPEB plans, a goodwill impairment charge, a deferred tax valuation allowance and restructuring costs – and their applicable impact on each period is in Q&A #1 on page 16. Because Caterpillar does not consider these items to be indicative of earnings from ongoing business activities, the table above shows adjusted profit per share that excludes them. The company believes adjusted profit per share provides a useful perspective on underlying business results and period-over-period changes.

Adjusted profit per share in the fourth quarter of 2016 was $0.83, the same as the fourth quarter of 2015, but higher than the outlook for profit per share excluding restructuring costs provided in October 2016. Adjusted profit per share in 2016 was $3.42, down from $5.35 per share in 2015. For the year, the impact on profit from lower sales and revenues was mitigated by a $2.3 billion reduction in period costs and variable manufacturing costs.

“Our results for the fourth quarter, while slightly better than expected, continued to reflect pressure in many of our end markets from weak economic conditions around much of the world. Our team did a great job in the quarter, as they have all year, aligning our cost structure with current demand while preserving capacity for the future. I’m confident we are focusing on the right areas: controlling costs, maintaining a strong balance sheet and investing in the key areas important to our future,” said Caterpillar Chief Executive Officer Jim Umpleby.

2017 Outlook – Background

Positives

Caterpillar is seeing positive signs that could be early indications of modest recovery in several of businesses.

Resource Industries – Commodity prices at higher levels than a year ago, along with sequential improvements in parts sales in each of the last three quarters and improvements in quoting and order activity in the fourth quarter, suggest that mining-related sales may have bottomed.

Construction Industries – Sales in China began recovering in 2016; sales in Europe seem to have stabilized and could improve some in 2017; and sales in Brazil, which are off their peak by over 80 percent, could improve if the Brazilian economy begins to recover from recession.

Energy & Transportation – Gas compression remains strong, and Caterpillar has a solid backlog for turbines. If oil prices rise modestly and stabilize, it would be positive for the businesses that support drilling and well servicing.

Prospects for tax reform and an infrastructure spending bill in the United States are encouraging. While these initiatives would likely be a solid positive for many of Caterpillar’s businesses, it would not expect to begin to see meaningful effects of these changes until sometime in 2018.

Concerns

Resource Industries – While quoting interest in mining products has improved, Caterpillar is expecting miners’ capital spending to be about flat in 2017 after several years of decline. Sales of some large construction equipment within Resource Industries are likely to be down in 2017, compared with 2016.

Construction Industries – North America and EAME are the most concerning regions. While better economic growth and increased infrastructure spending may be on the horizon, the availability of used equipment has negatively impacted sales in North America during 2016 and Caterpillar expects some negative impact in 2017. It expects sales in Africa/Middle East to be down again in 2017 due to overall economic weakness and continued pressure on economies that rely on oil revenues to drive economic growth. In addition, continuing uncertainty related to Brexit remains a concern in Europe.

Energy & Transportation – Rail remains challenged with low traffic volume and a significant number of idle locomotives. Additionally, weakness in shipbuilding is expected to be negative for the marine-related sales; power generation sales are projected to remain weak; and industrial engine sales to original equipment manufacturers are expected to be lower than 2016.

2017 Outlook – Sales and Revenues and Profit

The expectations for 2017 are similar to those shared with investors in early December 2016. At that time, Caterpillar believed the analyst consensus for 2017 sales and revenues of about $38 billion was a reasonable midpoint expectation. The expectation for sales and revenues in 2017 are now slightly lower due to the strengthening of the U.S. dollar over the past two months, and as a result, the current outlook for sales and revenues in 2017 is a range of $36 billion to $39 billion with a midpoint of $37.5 billion.

Caterpillar expects profit per share of about $2.30 at the midpoint of the sales and revenues outlook range. Excluding restructuring costs of about $500 million, the company expects adjusted profit of about $2.90 per share at the midpoint, which reflects decremental operating profit pull through of about 30 percent from 2016.

“We continue to execute in a challenging economic environment and are focused on improving operating margins, profitability and shareholder returns. While we see signs of positive activity in some of the key end markets, the overall economic environment remains challenging,” added Umpleby.

![[VIDEO] Cat Revenues Plunge in 2016 with More Expected for 2017](https://img.forconstructionpros.com/files/base/acbm/fcp/image/2017/02/default.58a48a1c6ef97.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)