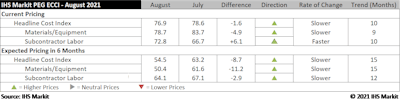

The August 2021 headline IHS Markit PEG Engineering and Construction Cost Index decreased 1.6 index points from July to 76.9, though construction costs continue to rise, according to IHS Markit (NYSE: INFO) and the Procurement Executive Group (PEG). For the ninth straight month, the materials and equipment sub-index remained above 50, indicating increasing prices, but the sub-index fell 4.9 points from last month to 78.7. The subcontractor labor index recorded 72.8, a 6.1 index point increase from the previous month, indicating a consensus for a quickening pace of labor costs increasing among respondents.

In August, all categories within the materials and equipment index increased individually for the eighth straight month, as well, though index levels have fallen further from peak levels experienced earlier in the year for most categories.

- The sub-index for electrical equipment fell from 72.2 in July 2021 to 66.7 in August 2021.

- The sub-index for transformers also fell from 72.2 in July to 70.0 in August.

- Costs of ocean freight from both Europe and Asia to the United States officially increased for a continuous calendar year, though the pace of price increases are slowing. The sub-index for the Asia to United States route fell from a level of 100.0 to 95.0, while the sub-index for the Europe to United States route fell from 100.0 to 88.9.

“Recently, there have been a slight moderation in shipping costs, though freight rates are still at historical highs and we don’t see evidence of rates falling,” according to Tal Dickstein, Senior Economist, Pricing & Purchasing, IHS Markit. “We are going to continue to see upward pressure on rates because of losses in capacity globally, as well as ongoing challenges due to COVID-19. For example, we recently witnessed terminal closures in the Port of Ningbo and productivity has fallen 20%. As the third largest port in the world, this will certainly have an immediate impact on congestion and instances like these continue to disrupt the flow of shipping. Just looking at the China Containerized Freight Index, July 2021 levels came in 240.6 percent higher than the same month in 2019.”

The sub-index for current subcontractor labor costs came in at 72.8 in August, another jump from July’s index figure of 66.7. According to survey responses, labor costs continued to expand in all regions of the United States and Canada, particularly in the U.S. West.

The six-month headline expectations for future construction costs index measured 54.5 in August, as respondents expect prices to continue increasing into the beginning of 2022. Yet, many of the sub-indices are showing measures much lower than 50.0. As reference, measures above 50 indicate expectations of higher input costs over the next six months. These sub-index totals are indicating that survey respondents are beginning to expect less input cost inflation than observed earlier in 2021.

- The fabricated structural steel sub-index fell from 50.0 in July 2021 to 34.6 this month.

- Carbon steel prices are still expected to decline over the next six months, as the sub-index recorded a point total of 30.8 this month after dropping to 45.0 in July 2021.

- Carbon alloy steel prices are expected to decline over the next six months as well. The sub-index for this category fell from 50.0 in July 2021 to 38.5 this month.

The six-month expectations index for sub-contractor labor recorded a reading of 64.1, as labor costs are expected to continue increasing in all regions of the United States and Canada. Yet, this sub-index total is 2.9 index points lower than last month’s reading of 67.1.

Most survey respondents did not report any shortages for materials and equipment currently, though some respondents are reporting shortages for specific technical labor in the concrete and wire and cable industries. Respondents still note extremely high freight rates, delays for orders, and limited container availability.