Portland Cement Association (PCA) Chief Economist and Senior Vice President of Market Intelligence, Ed Sullivan, provided his annual economic forecast summary to kick off World of Concrete 2023 on Tuesday.

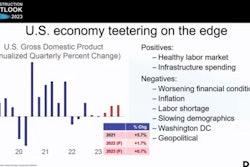

Sullivan is projecting a gradual weakening of the U.S. economy under high inflation, rising interest rates and geopolitical turmoil. Sullivan also cautioned that the impact of the infrastructure bill on the construction industry and the U.S. economy as a whole, will not be as much of a boon as many were hoping for either.

However, Sullivan’s view of the U.S. economy remains more optimistic than many.

Long Lag Times, But No Recession

During his presentation, Sullivan stressed that impacts in the economy are not felt in the near-term. Instead, there are long lag times to take into account when creating a forecast. These lag times range anywhere from 12-18 months, meaning the economy could possibly not reflect the impact of interest rate increases made by the Federal Reserve last spring, until the winter of 2023.

Plus, Sullivan says there’s a chance that the Fed could become more aggressive in its rate hikes because the economy has shown near-term resilience over the last year. If further hikes are made, the impact timetable stretches even further, well into 2024.

Sullivan expects the Fed to further increase rates through the spring of 2023, before rates start to ease later in the year.

“I’m painting the picture where near-term, the economy is doing well…but [becoming] much weaker later this year and into 2024,” Sullivan said.

However, Sullivan declined to use the R-word for the state the economy has been in or will be in.

“We’re taught that two successive non-growth quarters is a recession. That’s wrong,” Sullivan said. Instead, he pointed at the unemployment rate as the best gauge. He displayed a slide of the last several economic recessions and pointed out that the lowest unemployment rate seen during those recessions was 6.1%.

As of this writing, the rate was at 3.7%.

“The highest I’ve got unemployment reaching is 4.7%,” Sullivan said, as basis for his belief that the country is not in a recession and will not be entering one. “I’m assuming participation in the workforce will go up, but if it doesn’t, that unemployment rate will be even lower (than 4.7%)."

Private Sector Declines in 2023

With home prices and mortgage rates having risen sharply in the last couple of years, residential demand has fallen along with home affordability nationwide. Compounding the private sector construction industry’s problems is that the impact of COVID-19 is still being felt in nonresidential. As workforces shift to remote work and businesses were shuttered completely by the pandemic, occupancy rates have cratered as vacancies have skyrocketed.

The impact on demand for cement is a decrease from the office sector of 350,000 to 500,000 metric tons per year. On the retail side the decline tops 1 million metric tons in diminished demand. In the face of this drop in activity, banks have tightened lending standards for first time on commercial loans since 2008, Sullivan says, noting these issues still have to run their course and will cause nonresidential construction to decline this year before stabilizing in 2024.

As a result, Sullivan is forecasting a 3.5% decline in concrete consumption in the private sector — the first annual decline in consumption in 13 years.

Smaller Public Sector Growth Than Anticipated

As mentioned earlier, Sullivan says spending related to the infrastructure bill will increase demand for cement in 2023, but will not generate quite the amount of activity many were hoping for.

“The anticipated increase in public construction associated with the infrastructure bill is expected begin to materialize during the first half of 2023–but at initial volumes that may disappoint many,” Sullivan said, pointing out the following near-term factors diluting the infrastructure bill’s impact:

- It will take four years to see the full impact of spending because of the graduated rate of allocated funds actually spent.

- If states know they’re going to get money, they cut back their own state programs a little.

- Inflation almost hit 10% in the past year. In construction, the inflation rate is double and will hit again next year, taking down the effectiveness of real spending.

In other words, “The infrastructure bill will not offset things,” Sullivan said. “I don’t mean to downplay the importance of the infrastructure bill; it’s just not going to be as much as some people hoped.”