Material prices have sky-rocketed, the supply chain is straining to keep up, and the labor shortage remains an ever-constant challenge. According to the Associated Builders and Contractors (ABC) analysis of the U.S. Bureau of Labor Statistics’ Producer Price Index data, non-residential construction input prices have increased 1.8%. for June. This marks a 20% increase from a year ago.

Yet, it is possible that this also marks “peak inflation.” ABC Chief Economist Anirban Basu, states in their announcement, “It’s no secret that contractors and their customers have been walloped by massive increases in construction materials prices. That inflation continued through June, as reflected in the decline in profit margin expectations seen in the most recent reading of ABC’s Construction Confidence Index.”

However, Basu also added that more recently, “key commodity prices have declined.”

James R. Baty II, F.ACI, F.TCA, and executive director of the Concrete Foundations AssociationConcrete Foundations Association

James R. Baty II, F.ACI, F.TCA, and executive director of the Concrete Foundations AssociationConcrete Foundations Association

“[Concrete contractors] are constantly facing this issue of ramping up volume and price adjustments because the concrete industry was delayed in their price adjustments. And so now they've been aggressively taking 4 and 5% increases consecutively over the last two quarters,” says Baty.

Keeping up to date with price increases has been the crux of the issue. Contractors often bid out to customers 60 to 90 days in advance, and during this timeframe, the price of the quoted materials case increase sometimes multiple times.

Maria Davidson, CEO and Founder of KojoKojo

Maria Davidson, CEO and Founder of KojoKojo

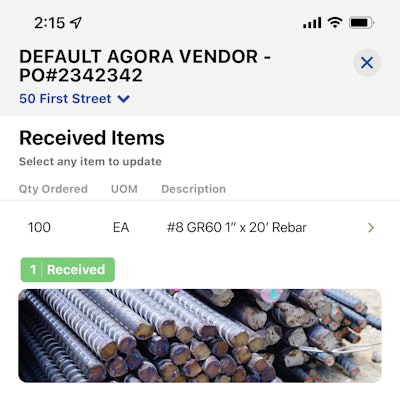

Despite this, contractors' work must continue. Supplies must be ordered and shipped and tracking the flow of materials can often be challenging. For example, contractors may receive an invoice by tonnage when rebar is delivered in multiple deliveries but the challenge comes in knowing what materials were exactly received and reconciling the contract with the vendor.

If these pricing and shortages weren't enough, a considerable amount of waste is being created. According to the EPA, 24.2 million tons of concrete was wasted during construction alone in 2018. Of this construction and demolition waste, 67.5% comes from concrete.

As Baty mentioned, this is a complex and complicated time, so any small gain of control regarding their supply chain as well as limit waste can have a significant effect on the bottom line. How can contractors (better) manage?

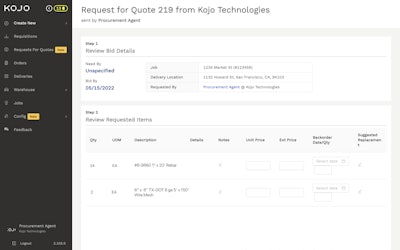

For one, put away the pad of grid-lined paper and dry-erase whiteboard markers. Modern software solutions are designed to save contractors time and money and allow them to do what they do best: build. And the CFA, an organization representing concrete contractors across the U.S. and Canada, has put its sights on empowering its members to do just that with this latest partnership with Kojo.

A mobile and desktop app can make confirming delivered materials easier via a digital receipt.Kojo

A mobile and desktop app can make confirming delivered materials easier via a digital receipt.Kojo

"Kojo uniquely understands the daily challenges that our contractors face," says Baty. "This partnership with Kojo is an important part of CFA's broader focus to bring the best tools and resources to our members, and we believe it will greatly benefit our industry."

"Kojo is on a mission to make it faster, easier, and more sustainable to build the world around us. It is an honor to work side by side with CFA and their members to advance this goal through our partnership," says Davidson. "By bringing our insights, best practices, and products to CFA members, we can help them take control of their materials procurement processes and protect their profit margins."

More of CFA’s partnerships can be found through its ever-growing online directory at cfaconcretepros.org.

With increasing supply chain disruptions, inflation, and the need to address concrete waste and its environmental impacts, it is more critical than ever for concrete contractors to gain control over how they procure and manage materials.

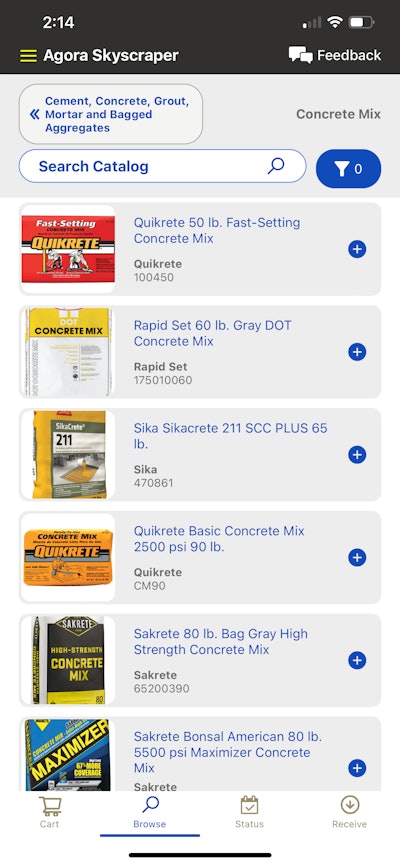

Trusted by hundreds of contractors and utilized by thousands of construction professionals across the country every day, Kojo’s platform enables trade and self-perform general contractors to take control of their margins by consolidating the procurement process onto one, all-inclusive digital platform. By connecting the field, office, warehouse, accounting teams, and vendors, contractors gain visibility into real-time materials spending and usage, streamline workflows, and increase labor productivity. Contractors have access to thousands of vendors to source the best prices and availability, find cost savings and reduce material waste.

Kojo

Kojo

The partnership with the CFA follows the company’s recent expansion into the concrete trade. In May 2022, Kojo grew its platform to serve every major trade including mechanical, drywall, roofing, flooring, and self-performing general contractors.

Contractors using Kojo save 3-5% per order on average or the equivalent of hundreds of thousands of dollars per year. In the field, Kojo decreases the time supervisors spend managing materials by up to 38% - an average of $175,000 in annual productivity gains. For office teams, Kojo claims that its automated manual data entry saves the equivalent of $124,000 per year by shortening the time to process each purchase order by up to 75%.

John Mraz, owner of Einheit Electric Construction Co., found the company’s solutions changed how they manage their supply chain. "By just using Kojo's Request For Quote feature, I would say we're achieving 10-20% in material savings. The money we save through Kojo allows us to invest further in our team, grow our business, and focus on what we do best – build," he says.

With access to thousands of vendors, concrete contractors can find cost savings and potentially reduce material waste by sourcing the best prices and availability.Kojo

With access to thousands of vendors, concrete contractors can find cost savings and potentially reduce material waste by sourcing the best prices and availability.Kojo

“We spoke about [cash flow] several times during this last convention (CFACon22, Boston, July 7-9) about the essential nature of managing cash flow,” says Baty. Using steel form ties and steel rebar as examples, he explains that ordering in volume can negatively influence your cash flow – even if the materials are as vital as these. Even with the alternative reinforcement options, both steel ties and rebar have seen long lead times in procurement.

“If you’re constantly ordering in volume, you’re bringing this material as fast as you can order it, trying to project out of what you’re going to need over the next two quarters because you can’t risk running low. From there, you’re doling them out incrementally or breaking those shipments down. All that influences your cash flow. I think concrete contractors are looking for ways of managing that. Having identification moments that says, ‘Here's where you're at in inventory; Here's where you're at on billing; Here's where you're at on receipt, receivables; and where are you at risk for influencing that cash flow.”

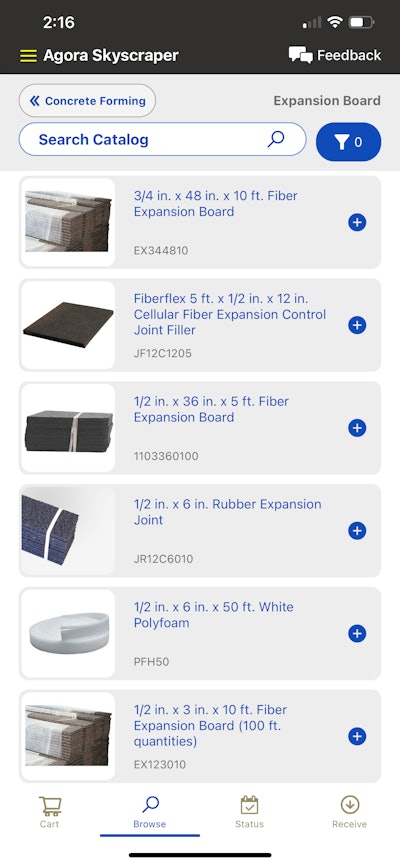

Kojo is dedicated to making their solution more robust to meet evolving contractor needs. In the last year, they’ve launched a warehouse product to help contractors track warehouse inventory and the ability to upload your bill of materials from your estimating software to better plan your project's materials spend.

“We built this product exclusively for the construction industry. It's not a generic horizontal product that we're trying to feed into the construction industry. Like we literally built this for construction,” says Davidson. Everything that we build is always with the mentality of how can we minimize the amount of taps or the amount of keystrokes that you have to do in order to get what you need done.”

Kojo

Kojo

The project-level planning product allows contractors to track projects in real-time compared to estimates, in both quantity and price.

But Kojo isn’t done. “Soon, we’re releasing an accounts payable reconciliation product to automate the process behind the manual three-way match between delivery receipt, invoice, and purchase order,” says Davidson. This will make sure contractors are only paying for what they ordered and what actually arrived – avoiding overcharges or paying for invoices they shouldn’t be.

“We’re also looking to build out more payments functionalities. Something we hear from concrete contractors all the time is that doing payments through one port will be a lot easier,” she says.

“Cash flow is king,” adds Baty. While the easiest thing to do is to keep stuffing the funnel with ordering and selling, he explains that it’s important to make sure to evaluate how those come together. “That’s what distinguishes the difference between a company being a job owner and being a business owner. That’s what the CFA about - bringing companies together to all be better business owners, not just job owners.”

Kojo is new to the concrete industry but they have a lot of early adopters jumping on board. After using pen and paper or Excel for 30 years, many have hesitations inquiring on how intuitive the software may be. But that’s where the CFA can help provide connection through its “Expert Connect.”

CFA’s Expert Connect is a product of the pandemic where they are able to pair members with experience and lean into them for advice.

“I think the biggest risk for concrete contractors in today's day and age is the status quo,” says Baty. It’s thinking ‘I'm too busy,’ ‘I don't have the time,’ ‘I don't have the resources to invest in a system that will lead to efficiency.’”

Members can benefit from the Kojo/CFA and other partnerships by knowing that CFA spends significant time vetting each solution. “Most concrete contractors are small enough that they’re not going to have the ability to go out and find a solution – or may not even think that is a possible solution out there,” he says. “But with our partnerships, [the CFA] can have this ready-made package to deliver and answer needs. That’s the role of the association – connecting the needs of the industry with the needs of technology with the presence of a trusted solution.”

“Now's the right time,” Baty continues. “I heard ITR economics talk about forecasting and how we're going to see a little bit of a soft landing. Things are going to slow just enough that contractors have some mental space and some time in their schedule, that they really need to invest in their future. What better time than now.”