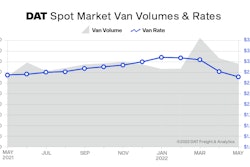

ACT Research's latest freight report, released this week, shows demand for freight softening as consumer demand calms alongside increasing prices. This is a shift after two years of heavy demand due to pandemic-related lockdowns.

The latest installment of the ACT Freight Forecast, U.S. Rate and Volume OUTLOOK report provides forecasts through 2024 for volumes and contract rates for the truckload, less-than-truckload and intermodal sectors of the transportation industry, including the Cass Shipments Index and Cass Truckload Linehaul Index.

“Growing evidence of weaker goods consumption, rising services substitution and rebuilt inventories, with some categories now overstocked, was perhaps the most impactful news in freight this month. Recent reports from key retailers, including price cuts and order cancellations due to overstocking, show lower real goods consumption and an inventory cycle that has largely played out after two strenuous years," said Tim Denoyer, ACT Research’s vice president and senior analyst.

ACT Research

ACT Research

Trucking employment increased, with 27,300 new jobs added during the past two months.

"The driver market recently swung from shortage to surplus. Were that not the case, rates would still be rising," he said. "Now that the pendulum has begun to swing, ‘how bad?’ and ‘how long?’ have become key questions. Rates are falling below elevated costs, which is already threatening recent entrants who paid top dollar for used equipment, heading into sharply higher fuel costs and lower spot rates. With equipment still constrained, we expect a sharper, but shorter downcycle in freight markets.”