Year over year, the May 2022 DAT Truckload Volume Index (TVI) was 10% higher for van freight, 11% higher for reefers and 29.7% higher for flatbed loads. Demand for truckload services was strong relative to May 2021 and the overall number of loads on the spot market increased. Shippers continue to see increased routing guide compliance as carriers cover more freight under contract compared to the same period last year.

“Demand for truckload services was solid last month, even on the spot market, where the number of available loads has fallen throughout the year,” said Ken Adamo, DAT chief of analytics.

The DAT Truckload Volume Index (TVI) is produced by DAT iQ and reflects the change in the number of van, refrigerated and flatbed loads moved with a pickup date during that month. Index numbers are normalized each month to accommodate any new data sources without distortion.

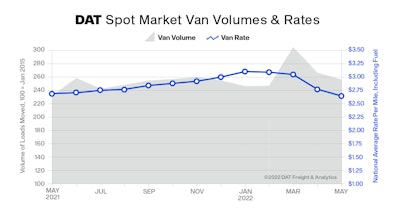

Month over month, truckload freight volumes declined for the third straight month in May and the average rate to move dry van freight on the spot market dipped below $2 per mile excluding fuel surcharges for the first time since July 2020, according to DAT Freight & Analytics.

The May 2022 TVI for dry van freight was 256, 3.7% lower compared to April while the refrigerated TVI was 190, also down 3.7% month over month. The flatbed TVI was 240, a 4.8% increase.

But, Adamo said, “there were more than 1 million dry van loads during each week in May, which has happened only once, in 2021.”

Prices paid by shippers to move contracted freight hit record highs in May. Van freight averaged $3.29 per mile, up 3 cents compared to April, while the average contract reefer rate was $3.56 a mile, up 11 cents. The flatbed rate jumped 7 cents to $3.84 a mile.

Spot Load-posting Activity Up 14%

Compared to April, there were 14% more loads posted in May as seasonal retail goods, fresh produce, construction materials and other freight moved through supply chains. Truck posts declined 2.3%.

The national average van load-to-truck ratio increased from 3.4 in April to 4.4; there were 4.4 loads for every van. The ratio was the second highest on record for May. The reefer load-to-truck ratio was 7.5, up from 6.3, while the flatbed ratio fell from 64.5 to 63.3.

Spot Van, Reefer Rates Dipped 7 Cents

“The price of diesel fuel continued to put downward pressure on spot truckload rates and cause small carriers to be discerning about the loads and terms they accept,” Adamo said. “We expect this volatility to continue through June.”

The national average van rate decreased 7 cents to $2.69 per mile, equal to the May 2021 average. The spot reefer rate was $3.06 per mile, down 7 cents, and the flatbed rate added 3 cents to $3.44 per mile.

Spot rates are negotiated by the carrier and freight broker as one-time transactions and should incorporate an amount to help cover the carrier’s fuel expense based on diesel prices at the time. Surcharges in May averaged 72 cents a mile for van freight, 79 cents a mile for reefers and 86 cents a mile for flatbed freight.