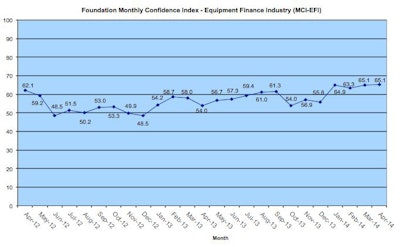

The Equipment Leasing & Finance Foundation's April 2014 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI)? remained at 65.1, the highest index level in two years for the second consecutive month.

When asked about the future outlook, MCI survey respondent Thomas Jaschik, president of BB&T Equipment Finance, pointed out that new business activity in the first quarter of 2014 was positive, and the economy is growing.

"The conclusion of the winter of 2013-2014 may be the catalyst for pent-up demand to begin to be released," Jaschik said. "This will have a positive impact on the equipment finance market throughout 2014.”

April 2014 Survey Results:

- The overall MCI-EFI is 65.1, unchanged from the March index.

- When asked to assess their business conditions over the next four months: 37% of executives said they believe business conditions will improve, up from 31.4% in March. 60% of respondents believe business conditions will remain the same over the next four months, down from 65.7% in March. 2.9% believe business conditions will worsen, unchanged from the previous month.

- 37% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, up from 31.4% in March. 60% believe demand will “remain the same” during the same four-month time period, down from 62.9% the previous month. 2.9% believe demand will decline, down from 5.7% who believed so in March.

- 28.6% of executives expect more access to capital to fund equipment acquisitions over the next four months, a decrease from 31.4% in March. 71.4% of survey respondents indicate they expect the “same” access to capital to fund business, up from 68.6% in March. No one expects “less” access to capital, unchanged from the previous month.

- When asked, 37% of the executives reported they expect to hire more employees over the next four months, a decrease from 40% in March. 60% expect no change in headcount over the next four months, unchanged from last month. 2.9% expect fewer employees, up from no one who expected fewer employees in March.

- 2.9% of the leadership evaluates the current U.S. economy as “excellent,” down from 5.7% last month. 91.4% of the leadership evaluates the current U.S. economy as “fair,” up from 88.6% last month. 5.7% rate it as “poor,” unchanged from March.

- 34.3% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 31.4% who believed so in March. 62.9% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 68.6% in March. 2.9% believes economic conditions in the U.S. will worsen over the next six months, an increase from no one who believed so last month.

- In April, 40% of respondents indicate they believe their company will increase spending on business development activities during the next six months, a decrease from 45.7% in March. 60% believe there will be “no change” in business development spending, an increase from 54.3% last month. No one believes there will be a decrease in spending, unchanged from last month.

Comments from Industry Leadership

Independent, Small Ticket

“I believe there are many projects that were put on hold during the last quarter due to the difficult weather conditions this winter. Equipment acquisition should improve as these projects get back on track as economic conditions continue to improve and the weather turns more favorable. The concerns I have are for the increasing amount of capital that continues to enter the marketplace bringing a downward pressure on yields.” Valerie Hayes Jester, President, Brandywine Capital Associates, Inc.

Bank, Small Ticket

“It seems that the U.S. consumer is gaining confidence, which may translate into increased spending. When this segment of our economy actually gains real traction, we will see tangible growth in GDP. The one caveat is the threat of a global event that could stall our cyclical recovery.” Paul Menzel, President & CEO, Financial Pacific Leasing, LLC

Bank, Middle Ticket

“The industries we serve continue to make capital investments to support growth activities. Drought in some areas of the country may curtail capital investment this year.” Michael Romanowski, President, Farm Credit Leasing Services Corporation