Robust revenue growth, particularly in Asia Pacific and North America, on the back of continued low interest rates and stabilizing commodity prices will underpin the stable outlook for the global construction sector into 2018, says Moody's Investors Service.

"Many developed economies are increasing their infrastructure spending as a result of stable commodity prices and ongoing low interest rates. This jump in spending will push revenues up by as much as 8% in some regions and support our stable outlook on the global construction sector over the next 12 to 18 months," says Matthias Heck, Vice President -- Senior Analyst at Moody's.

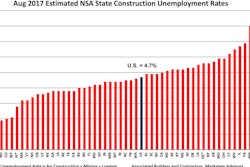

North America and Asia Pacific will post the most robust revenue growth of around 5% and more. In APAC, Moody's expects growth of around 5%-7%, driven by ongoing good growth in China and strong government road and rail infrastructure spending in Australia.

Moody's expects revenue growth rates of 4% to 6% in the US and Canada, driven by large infrastructure plans and residential construction. In Canada, growth will be supported by more stable commodity prices.

Conversely, European construction revenue will likely stagnate over the next 12-18 months with modest recession in some countries (including Italy) and up to 4% growth in other countries (including Germany). A post-election increase in new infrastructure projects will grow German construction volumes, while Brexit uncertainty will weaken UK volumes.

In Latin America, the engineering and construction sector will remain stalled in 2017-18 on the back of recession, government budget cuts, weak order intake and project cancelations linked to corruption scandals. Moody's expectation ranges from flat revenues down to a 5% recession over the next 12-18 months.

Ongoing difficult macroeconomic and geopolitical environments in many emerging markets, in Latin America and in Turkey and Russia, for example, will reduce investor appetite for concession assets, such as toll roads. This could weigh on construction activity in this segment as companies could find it harder sell existing assets and finance new projects.