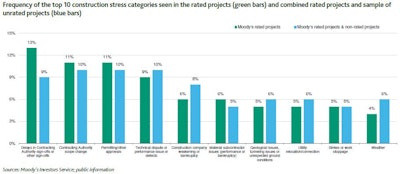

Moody’s has published a review of the various construction-related issues that have plagued public-private partnerships (P3s) over the past two decades. Of the approximately 80 rated projects that have been completed, only six were downgraded during construction, demonstrating the resiliency of the asset class.

P3s aren’t risk-free, however, and the report identifies 10 issues that account for almost 75% of all documented difficulties in the construction phase.

Generally, projects built by construction companies entering a new market tend to be more prone to problems. Very large projects of $1 billion or more also tend to be more prone to delays and cost overruns. We observe that certain structural and contractual elements in P3s protect the project company and its lenders from the impact of most construction issues. These include:

- Clear risk identification and allocation

- Conservative construction budgets and schedules

- Use of an experienced construction company

- Requirements that it pay delay liquidated damages and post sufficient security in case of bankruptcy

According to Catherine Deluz, the lead author of the report, "Many potential construction risks can be identified upfront, but surprises can still occur. As part of our credit analysis, we review how construction companies identify and mitigate some of the key perceived risks to which they will be exposed when carrying out the project."