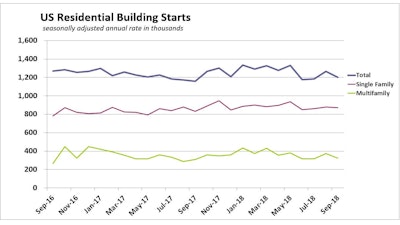

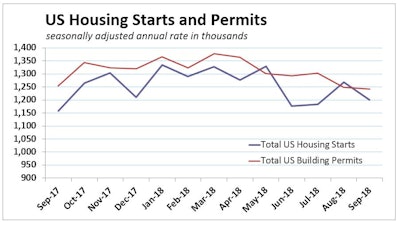

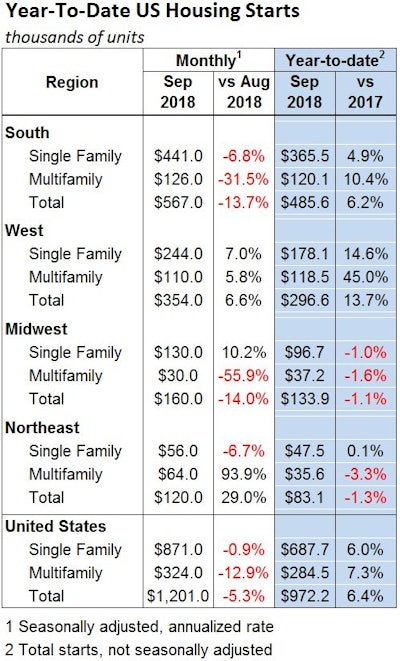

Total U.S. housing starts in September came in below expectations and declined 5.3%. Department of Commerce data indicates much of the decline occurred in volatile multifamily starts, which dropped 12.9%. New single-family units fared a little better delivering a 0.9% decline. Building permits also slipped, by 0.6%.

Some of September’s weakness may be owed to Hurricane Florence, which hit the Carolinas in mid-September. Starts in the South, the largest region for U.S. home building by far, fell 13.7%. Starts in the West rose 6.6%, with a 7.0% jump in single-family production. Total starts in the South and West year-to-date are well above 2017 on balanced strength in single- and multifamily sectors.

The Midwest saw a steep 14.0% drop in starts on a 55.6% plunge in multifamily construction. Single-family starts jumped 10.2%. The Northeast posted the strongest monthly gain, rising 29.0% on a 93.9% spike in multifamily construction. Single-family starts fell 6.7%. Total Midwest and the Northeast starts in 2018 are both down more than 1% year to date.

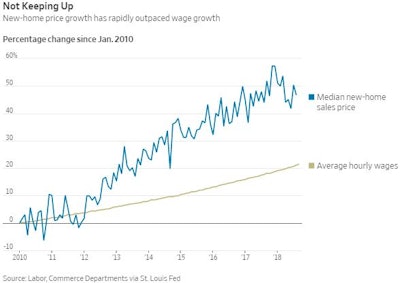

While home-price growth has moderated in recent months, it has outpaced wage growth for years.Wall Street Journal

While home-price growth has moderated in recent months, it has outpaced wage growth for years.Wall Street Journal

“As there are less buyers at each price point, the appropriate market response is a slowdown in sales and an eventual easing in price momentum,” said LendingTree Chief Economist Tendayi Kapfidze. “We need affordability to improve for the housing market to regain momentum.”

Related:

"It may be tempting to draw national conclusions from these storm-related dips and rallies, but the regional blips can't obscure the year-long malaise in the national single-family home construction market: Starts have been hit or miss, sales flat and permits trending downward for months," Aaron Terrazas, a senior economist at real estate firm Zillow, quoted by ABC News.