In a Sector In-Depth report released April 28, Moody’s Investors Service concluded the equipment rental industry will build liquidity for short-term resilience. As the economic downturn deepens throughout the next several months, demand for the industry will decline, the report says.

To read the full report, visit Moody's.

Report highlights include:

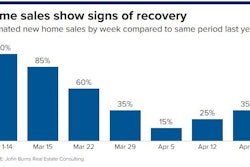

- Although deemed an “essential” industry, the use of rental equipment will slow as construction projects are put on hold across the United States. Equipment rental will likely decline 10% to 20% from 2019 levels, in the near term.

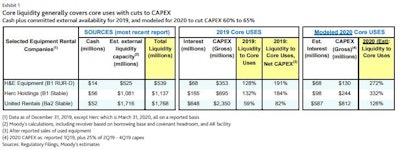

- As equipment rental companies cut capital spending and sell used equipment, their liquidity will strengthen, especially as they continue to collect rents and sell used equipment.

- The industry, which was experiencing a slowdown in the fourth quarter of 2019, has been boosting liquidity for months, in anticipation of a sluggish 2020.

- Cuts to spending by equipment rental companies will put a stress on equipment suppliers and the supply chain.

- If the economic downturn continues long term, the industry will experience cash flow challenges. If the recession lasts longer than a few quarters, the initial cash flow benefits experienced by equipment rental companies will not be sustainable.

Equipment rental companies reviewed for the report include United Rentals (Ba2 stable), Herc Rentals (B1 stable), H&E Equipment Services (B1 review for downgrade) and Ahern Rentals (B3 review for downgrade). The report also rated Ashtead Group (Baa3 stable) out of Europe, which has a large presence in the United States operating as Sunbelt Rentals.

Moody’s had changed its projection on global construction on April 20, based on an expected decline in construction activity, especially for commercial projects. Projects within the energy and mining industries are also expected to be delayed.

One factor that will mitigate the decline in the equipment rental industry is the use of rented emergency equipment, such as aerial work platforms and cranes, during the COVID-19 pandemic.