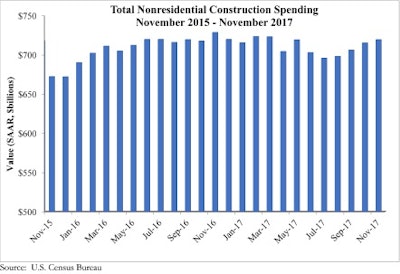

Nonresidential construction spending expanded 0.6% in November, totaling $719.2 billion on a seasonally adjusted basis, according to an Associated Builders and Contractors (ABC) analysis of U.S. Census Bureau data. Despite the month-over-month expansion, nonresidential spending fell 1.3% from November 2016.

Private nonresidential construction spending is down 3.1% year-over-year, while public sector spending has increased 1.7% over the same period. Spending in the manufacturing and power categories, two of the larger nonresidential subsectors, fell by a combined $21.7 billion over the past year.

Bucking the trend over the past several years, public construction spending rose while private construction spending shrunk on a year-over-year basis.

Bucking the trend over the past several years, public construction spending rose while private construction spending shrunk on a year-over-year basis.

“There are several possible explanations, including growing concerns about overbuilding in a number of large metropolitan areas in the lodging, office and commercial categories,” said Basu. “Financiers may also be less willing to supply financing to a variety of private projects given such concerns. At the same time, the U.S. housing market is the strongest it has been in at least a decade, raising sales prices and expanding assessable residential tax bases. That in turn has supplied additional resources for infrastructure. Over the past year, this has been particularly apparent in the educational and public safety categories.”