PlanGrid, a leader in construction productivity software, shared results from a new industry research report, administered in partnership with management consulting firm FMI Corporation,  PlanGrid/FMI

PlanGrid/FMI

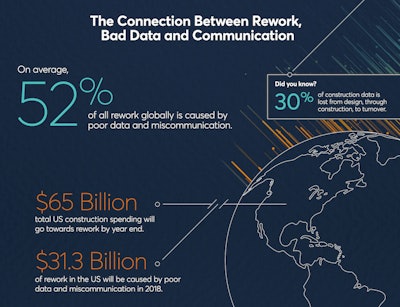

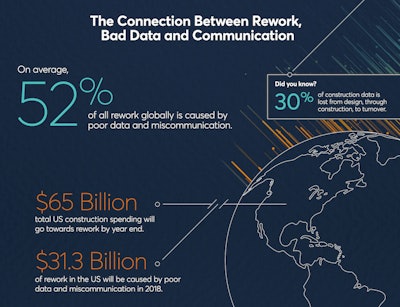

The study also found that rework caused by miscommunication and inaccurate and inaccessible information will cost the U.S. construction industry more than $31 billion in 2018.

Key survey findings include:

Construction workers lose almost two full working days each week solving avoidable issues and searching for project information.

Each construction project team member spends more than 14 hours each week on average dealing with conflict, rework and other issues that take away from higher priority activities, according to the survey. Respondents revealed they spend the following amount of time each week on non-optimal activities including:

- Five and a half hours hunting down project data, such as revised drawings, material cut sheets and other information relevant to the job.

- Almost five hours on conflict resolution, including managing disagreements between stakeholders such as the general contractor, owners and subcontractors responsible for the delivery of the project.

- Four hours dealing with rework-related activities, such as managing the mistakes on a project that result in rework, assessing the associated costs and determining why the mistakes happened.

PlanGrid/FMI

PlanGrid/FMI

Almost half of all rework is due to poor communication among project stakeholders, and poor project information.

Miscommunication and poor project data account for 48% of all rework on U.S construction jobsites. Respondents attributed 26% of rework to poor communication between team members.

The top three causes of miscommunication are unresponsiveness of team members; the inability of project stakeholders to collaborate effectively; and the lack of a common platform for all team members to communicate and share project data.

Respondents also said 22% of rework is due poor project information, where the top three causes are erroneous or incorrect project data, difficulty accessing project data and the inability of project stakeholders to easily share information about the project.

Based on this data, FMI estimates poor communication represents a potential cost to the U.S. construction industry of $17 billion a year, and poor project data represents a cost of $14.3 billion, collectively accounting for a potential cost of $31.3 billion annually.

Workers are not taking full advantage of mobile devices and IT investments.

PlanGrid/FMI

PlanGrid/FMI

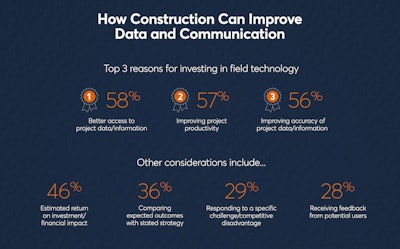

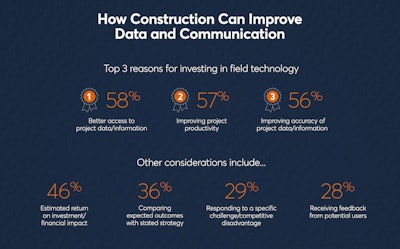

Technology is expected to improve data management and increase productivity.

According to the survey, executives are investing in technology for reasons that directly reflect the challenges associated with data integrity and accessibility, and overall demands for increased productivity. More than half of survey respondents shared the most common goals for technology adoption include providing better access to project data (58%), improving project productivity (57%) and increasing the accuracy of project information (56%).

PlanGrid/FMI

PlanGrid/FMI

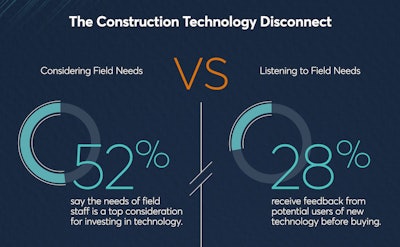

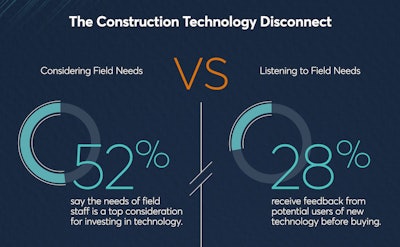

“Construction companies are investing in mobile devices, but many teams are still relying on simple text and email rather than tapping more robust technology to collaborate and access project information,” said Stuart Frederich-Smith, vice president of product marketing at PlanGrid. “This proves a significant disconnect between the purchase of construction technology and the adoption of this technology in the field, and reveals the need for end users to be included the decision making process. Teams that have easy-to-use tools to collaborate in real-time, a central source of truth and access to relevant data when they need it will have a greater competitive advantage.”

More details:

About the Survey

In April 2018, FMI Corporation partnered with PlanGrid to survey nearly 600 construction leaders and decision makers to discover how teams spend their time while on a jobsite, challenges associated with poor data management practices and miscommunication, and their technology investments. Participants in the study included 599 construction industry leaders.

The sample was composed of 500 respondents from the United States and 99 from Australia, New Zealand, United Kingdom and Canada. Of those surveyed, 49% work for general contractor firms, 36% came from specialty trades and 15% were owners. Over 300 respondents came from the commercial sector and the other respondents represent industrial and manufacturing, heavy civil, healthcare, power (oil and gas, and energy), education and government.

PlanGrid/FMI

PlanGrid/FMI

PlanGrid/FMI

PlanGrid/FMI

PlanGrid/FMI

PlanGrid/FMI

PlanGrid/FMI

PlanGrid/FMI

PlanGrid/FMI

PlanGrid/FMI

PlanGrid/FMI

PlanGrid/FMI

PlanGrid/FMI

PlanGrid/FMI