The global Mobile Elevating Work Platform (MEWP) fleet grew strongly in the past year, with the US market exceeding expectations and steady growth throughout Europe for the first time since the economic downturn, driven mainly by a resurgent construction industry and falling unemployment, according to the latest annual global rental market report from the International Powered Access Federation (IPAF).

In the US the MEWP, previously known as aerial work platform (AWP), rental market grew by 8% in 2015 to stand at a value of around $8.9 billion (£8.1bn), according to IPAF’s Powered Access Rental Global Market Report 2017, conducted by Ducker Worldwide.

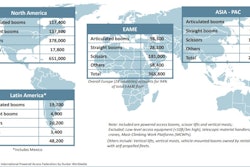

The size of the US rental fleet grew by 6% to around 561,000 units and demand was driven mainly (73%) by the booming US construction sector. The US market was characterized by a significant amount of merger and acquisition activity, while the wider North American market had to factor in the Trump presidency and looming ANSI and CSA Standards into the outlook for 2017.

The picture for the European MEWP rental market as a whole was also largely positive, growing in value by 4% across 2016 to stand at approximately €2.5 billion. Fleet size also grew in line with increased demand by around 3%, again mostly driven by a resurgent construction sector and improved economic outlook in many European countries, particularly Spain, which saw its rental fleet increase in size by around 7%.

The research showed that all 10 European countries under study – Denmark, Finland, France, Germany, Italy, the Netherlands, Norway, Spain, Sweden and the UK – are now back to pre-recession levels of activity and market strength.

In the UK the picture was also one of steady growth, with the UK MEWP rental market growing by around 3%, outstripping the wider construction industry, which grew by around 1% for the year.

The worldwide rental MEWP fleet size was 1.25 million units at the end of 2016, with Asia having shown very dynamic growth, driven in particular by booming demand in China, Japan and Hong Kong, while the Latin American fleet size actually contracted slightly, primarily owing to challenging economic conditions in Brazil and the completion of major construction and infrastructure projects related to the FIFA World Cup and Rio Olympics.

The report also contains for the first time a UAE focus, which highlights the fact that the market is growing steadily to stand at $93m at the end of 2016, driven mainly by some very large infrastructure and construction projects, not the least of which is Expo 2020. The MEWP rental fleet also grew substantially in the UAE to stand at 4,500 units, with boom-type machines accounting for approximately 70% of the fleet. Utilization stood at 78% and is forecast to increase as the drive to finalize large projects such as Expo 2020 continues to drive up demand.

The IPAF Powered Access Global Rental Market Report 2017 is compiled by Ducker Worldwide and is available in English only. The full report is available to purchase via www.ipaf.org/reports