According to Technavio’s latest report, the global construction equipment rental market is expected to exceed USD 110 billion by 2019 growing at a CAGR of over 7% during the forecast period.

The equipment rental industry is gaining huge prominence across the globe. Although, in emerging economies, such as Asia, the industry is still in the nascent stage, it is projected to witness high growth in the coming years. An increase in the awareness of the equipment rental industry and growing investment in the construction industry will drive the equipment rental market.

Asia and Europe are currently witnessing large-scale infrastructure development activities, which is raising demand for construction equipment. Also, as most of the projects are undertaken with private investment money, where the utilization of equipment is limited to a short duration, contractors prefer to use equipment on a rental basis.

According to Soumya Mutsuddi, a lead research analyst at Technavio for construction industry “Renting equipment not only reduces the ownership cost of the equipment, but contractors can reduce other costs pertaining to the use of equipment, such as maintenance costs and transportation costs, among others.”

In this report, Technavio covers the present scenario and growth prospects of the global construction equipment rental market for 2015-2019. The report also presents the vendor landscape and a corresponding detailed analysis of the top five vendors operating in the market. The market is segmented into the following four regions:

- Europe

- North America

- Asia

- Others

The other segment consisting of the Middle East, Africa, and South America accounts for only about 9% of the market share.

Europe: largest construction equipment rental market

According to Technavio, the construction equipment rental market in Europe is forecast to grow at a CAGR of over 7% to exceed USD 44 billion by 2019.

The economic slowdown during the period 2010-2013 had a huge impact on rental companies because of the decline in investments in the construction industry. However, the market has now picked up, with large-scale investment planned for infrastructure development across various countries in Europe. Countries such as Poland, Spain, Germany, and France are witnessing heavy growth in the construction industry.

Moreover, as most of the construction projects in Europe are handled by private sector investors who bid for specific projects, the equipment remains idle following the completion of the project. Therefore, in such cases, construction contractors prefer to rent the equipment rather than buy their own equipment.

Increasing competition among the rental companies is leading contractors to offer new product ranges and customized equipment to construction companies.

North America: established players drive growth

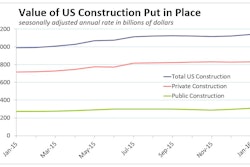

The construction equipment rental market in North America is expected to exceed USD 31 billion growing at a CAGR of over 7%. The region has well-established players operating in the equipment rental market, which is raising the competition and making the market more intense.

An increase in investments in the construction industry in North America, notably in the US, is resulting in rental companies expanding their business and investing in new product ranges so as to meet the equipment demand. For instance, In December 2014, Sunbelts, one of the largest rental companies in North America, acquired GWG Rentals. This acquisition helped Sunbelts to enter into the Canadian rental market.

Asia: emerging countries like India and China drive the construction equipment rental market

Asia is the third largest region in the global equipment rental market. The equipment rental market in Asia is growing at a steady pace and is expected to exceed USD 24 billion by 2019. The growth is prominent in countries such as India and China where there are only a few organized players operating in the construction equipment rental segment.

As a result of rising labor costs and slow economic growth, construction companies in these countries are focusing on the rate of return of each individual project. Therefore, it makes more sense for construction companies to rent used equipment rather than buy new equipment as it helps to reduce their operating costs.

Key Vendors:

- Hertz Equipment Rental

- Loxam Group

- Neff Rental

- Sunbelt Rentals

- United Rentals

Some of the other prominent vendors listed in the report are: ACCESS INDUSTRIE, Ahern Equipment Rental, American Equipment Company (Ameco), Finning, and Maxim Crane Works.