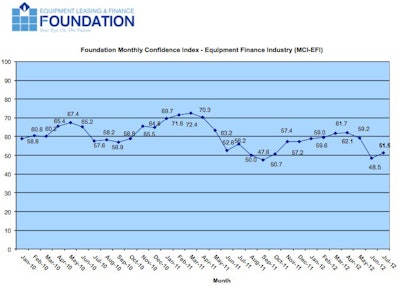

The Equipment Leasing & Finance Foundation (the Foundation) released the July 2012 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI), and confidence in the equipment finance market is 51.5, up from the June index of 48.5. This reflects continuing concern over external economic factors and regulatory and political uncertainty.

"Continued volatility/uncertainty at home and abroad may inhibit planned/needed capital expenditures during the next six months, but low interest rates and tax incentives will enable our industry to generate modest increases in asset volume and profitability through the remainder of 2012," said Russell D. Nelson, president, Farm Credit Leasing Services Corporation. "Improving credit quality, stable earnings and demand for innovative/creative lease and loan products should position our industry for improved growth in 2013 and beyond."

July 2012 Survey Results:

Business conditions over the next four months:

- 6.5% of executives responding said they believe business conditions will improve over the next four months, down from 8.1% in June

- 71% believe business conditions will remain the same over the next four months, up from 64.9% in June

- 22.6% believe business conditions will worsen, down from 27% the previous month

Demand for leases and loans to fund capital expenditures (capex):

- 12.9% believe demand will increase over the next four months, an increase from 8.1% in June

- 71% believe demand will “remain the same” during the same four-month time period, up from 64.9% the previous month

- 16.1% believe demand will decline, down from 27% in June

Access to capital to fund equipment acquisitions:

- 19.4% expect more access to capital over the next four months, up from 10.8% in June

- 77.4% expect the “same” access to capital, a decrease from 86.5% the previous month

- 3.2% expect “less” access to capital, up from 2.7% in June

Hiring:

- 35.5% expect to hire more employees over the next four months, up from 24.3% in June

- 64.5% expect no change in headcount over the next four months, virtually unchanged from 64.9% last month

- No one expects fewer employees, down from 10.8% in June

Evaluation of current economy:

- 71% of the leadership evaluates the current U.S. economy as “fair,” down from 78.4% last month

- 29% rate it as “poor,” up from 21.6% in June

- 9.7% believe that U.S. economic conditions will get “better” over the next six months, up from 8.1% in June

- 71% believe the U.S. economy will “stay the same” over the next six months, up from 64.9% in June

- 19.4% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 27% who believed so last month

Spending:

- 25.8% believe their company will increase spending on business development activities during the next six months, down from 29.7% in June

- 71% believe there will be “no change” in business development spending, up slightly from 70.3% last month

- 3.2% believe there will be a decrease in spending, up from no one who believed so last month

Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $628 billion equipment finance sector.