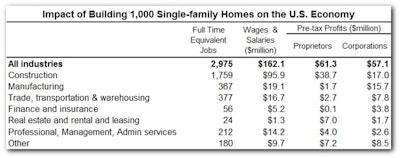

According to National Association of Home Builder’s (NAHB) National Impact of Home Building model, building 1,000 average single-family homes generates 2,975 jobs and $111.0 million in taxes and fees for all levels of government. Similarly, building 1,000 average rental apartments generates 1,133 jobs and $42.4 million in taxes.

The jobs are measured in full-time equivalents (enough work to keep one worker employed full-time for a year), and are broad-based. Although a substantial share of the employment is generated in the construction industry, other jobs are created for employees in firms that manufacture building products, transport and sell those products, and provide professional services to home builders and buyers (e.g., architects and real estate agents). A breakdown by industry is shown in the tables above, along with the wages and business profits generated.

In the construction industry, the profit generated for proprietors (individuals who own their own businesses) tends to be quite substantial relative to wages and salaries. This is largely due to the profit generated for owners of the subcontracting businesses that usually handle a large share of the construction work. In some cases, the owners of these businesses perform construction work themselves. In fact, this is essentially true by definition for the many one-person subcontracting firms that populate the industry.

Wages, profits and the construction activity itself are subject to a variety of taxes and fees that generate revenue for the approximately 90,000 different governments in the U.S. The $111.0 million in taxes and fees generated by 1,000 single-family home includes $74.4 million in federal taxes (mostly income taxes and Social Security), $10.3 million in state and local income taxes, $6.9 million in state and local sales taxes, and $13.7 million in impact, permit and other fees local governments impose on new construction.

Similarly, the $42.4 million in taxes and fees generated by 1,000 rental apartments includes $28.4 million in federal taxes, $3.9 million in state and local income taxes, $2.6 million in state and local sales taxes, and $5.4 million in permit and other construction-related fees collected by local governments. These fees are part of the government regulation that in total accounts for 24.3% of the price of a new home.

See NAHB’s National Impact web page for more detail and information on how the numbers are estimated. Keep in mind that all the numbers in this post are national in nature, with an emphasis on the suppliers of all the products and services that go into a new housing unit, no matter where in the country the suppliers are located. Do not try to use these national numbers to say something about economic impacts in the state or local area where the home is built. NAHB has a distinct set of Local Economic Impact estimates for that.