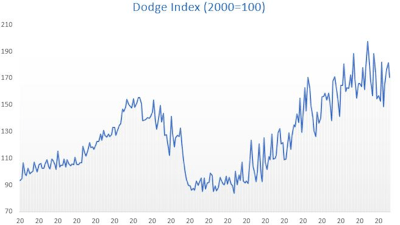

Dodge Construction Network is reporting that total construction starts declined 12% in March, but are up over last year.

The dip in construction starts can be attributed to the start of three major manufacturing facilities, the network reported. These larger projects signal a healthy building trend and overall strength in the industry, the network reported. It's also a sign that the economy is starting to recover from COVID-19 and its associated lockdowns, said Richard Branch, chief economist for Dodge Construction Network.

“The volatility caused by the ebb and flow of large projects masks an underlying trend of strengthening in construction starts,” Branch said. “Nonresidential construction has benefited from the growing confidence that the worst of the pandemic is in the rear-view window. The pipeline of projects waiting to start continues to fill, suggesting this trend will continue. However, higher prices and a shortage of skilled labor will slow the progress of those projects through the design and bidding stages, resulting in moderate growth in starts activity.”

Dodge Data & Analytics

Dodge Data & Analytics

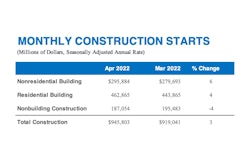

According to Dodge:

Year-to-date, total construction was 9% higher in the first three months of 2022 than in the same period of 2021. Nonresidential building starts rose 26%, residential starts gained 3%, while nonbuilding starts were 1% lower.

For the 12 months ending March 2022, total construction starts were 15% above the 12 months ending March 2021. Nonresidential starts were 25% higher, residential starts gained 15% and nonbuilding starts were down 1%.

Construction starts fell in March to a seasonally adjusted rate of $903.8 billion.

Below is the breakdown for construction starts:

- Nonbuilding construction starts declined by 2% in March to a seasonally adjusted annual rate of $194.5 billion. Starts in the environmental public works category rose 35%, and miscellaneous nonbuilding improved by 10%. Starts for highway and bridge projects lost 7%, and utility/gas plant starts shed 40% in March. For the 12 months ending March 2022, total nonbuilding starts were 1% lower than in the 12 months ending March 2021. Environmental public works starts were up 11%, and utility/gas plant starts rose 2%. Highway and bridge starts were up 4% on a 12-month rolling sum basis, while miscellaneous nonbuilding starts were 30% lower.

The largest nonbuilding projects to break ground in March were the $522 million second phase of the IH 35E Corridor project in Dallas, the $475 million first phase of the Mammoth Solar Project in Starke and Pulaski counties in Indiana and the $332 million I-17 Anthem Way traffic interchange in Phoenix.

- Nonresidential building starts fell 29% in March to a seasonally adjusted annual rate of $274.8 billion. The decline in March followed a large gain in manufacturing activity in February, which saw three large plants break ground. In March, commercial starts rose 8% due to gains in office, hotel and warehouse starts. Institutional starts increased 9% in March as starts in all sectors moved higher. For the 12 months ending March 2022, nonresidential building starts were 25% higher than in the 12 months ending March 2021. Commercial starts were up 21%, institutional starts rose 12% and manufacturing starts advanced 162% on a 12-month rolling sum basis.

The largest nonresidential building projects to break ground in March were the $505 million second phase of the Switch SuperNap data center in Sparks, Nev., the $460 million second phase of the Park 303 office building in Glendale, Ariz. and upgrades to the $410 million Exxon Mobil refinery in Baton Rouge, La.

- Residential building starts fell 3% in March to a seasonally adjusted annual rate of $435 billion. Single family starts fell 5%, but multifamily starts rose 4%. For the 12 months ending March 2022, residential starts improved 15% from the 12 months ending March 2021. Single family starts were 11% higher, while multifamily starts were 29% stronger on a 12-month rolling sum basis.

The largest multifamily structures to break ground in March were the $212 million 550 10th Ave. mixed-use building in New York City, the $200 million Kauanoe O Koloa condominiums in Koloa, Hawaii and the $140 million 7 Platt St. mixed-use building in New York City.

Dodge Data & Analytics

Dodge Data & Analytics

Regionally, total construction starts in March rose in the South Atlantic, but fell in all other regions.