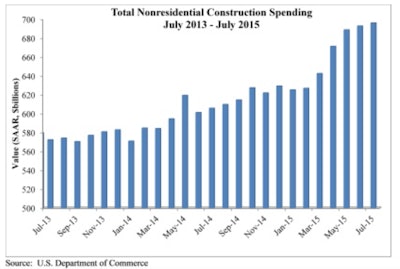

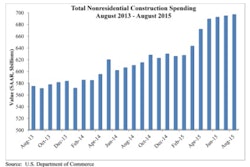

Nonresidential construction spending expanded 0.5% in July and is up 12.7% on a year-over-year basis, according to a Sept. 1 release by the U.S. Census Bureau. This represents the strongest year-over-year percentage growth in spending since April 2008. On a seasonally adjusted, annualized basis, nonresidential construction spending totaled $696.1 billion in July, which is the best reading since March 2009. Additionally, June’s estimate was upwardly revised 0.9% from $686.9 billion to $692.8 billion.

“A number of forces are at work and are conspiring to help push nonresidential construction spending higher,” said Associated Builders and Contractors Chief Economist Anirban Basu. “Perhaps most importantly, job growth remains robust, helping to drive down office and other vacancy rates, prompting more construction starts. Recreational and business travel spending has been trending higher, helping to support construction in the lodging and amusement categories on a year-over-year basis. A rebounding U.S. auto sector and expanding aerospace industry have also helped to fuel spending. State and local government capital outlays also appear to be recovering and were surprisingly strong during this year’s second quarter. In addition, materials prices have been in general decline, which has helped justify moving forward with construction projects.

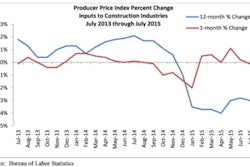

10 of 11 Key Construction Input Prices Fell or Remained Flat in July

“Among the factors suppressing spending growth is an ongoing lack of coherent federal policy regarding the nation’s infrastructure shortfalls and a weak global economy that has limited export growth,” said Basu. “Falling and volatile energy prices also have been making their mark, reducing investment in the category that had most helped support private nonresidential construction during the early years of spending recovery.

“For now, the outlook for nonresidential construction spending remains upbeat, as the positives significantly outweigh the negatives,” said Basu. “Trends in aggregate spending tend to lag the broader economy by roughly a year and the second quarter gross domestic product growth estimate of 3.7% is consistent with the notion that the broader economic recovery remains an ongoing one.”

Seven of 16 nonresidential construction sectors experienced spending increases in July on a monthly basis:

- Power-related construction spending grew 2.8% for the month but has declined 11.9% on a year-over-year basis.

- Manufacturing-related construction spending grew 4.8% in June and is up an astonishing 62.1% for the year.

- Office-related construction spending expanded 1.2% in July and is up 26.1% from the same period one year ago.

- Conservation and development-related construction spending expanded 11.2% for the month and is up 15.7% on a yearly basis.

- Religious spending grew 5.7% for the month and is up 7.3% from the same time last year.

- Communication-related construction spending inched 0.1% higher for the month and is up 14.2% for the year.

- Sewage and waste disposal-related construction spending grew 1.6% for the month and has expanded 11.3% on a 12-month basis.

Spending in nine nonresidential construction subsectors fell in July on a monthly basis:

- Education-related construction spending fell 2.2% for the month but is up 3.6% on a year-over-year basis.

- Commercial construction spending fell 1.5% in July but is up 5.5% on a year-over-year basis.

- Health care-related construction spending fell 0.5% for the month but is up 6.4% for the year.

- Lodging-related construction spending fell 0.7% on a monthly basis but is up 40.3% on a year-over-year basis.

- Spending in the water supply category fell 4.8% from June but is up 4.3% on an annual basis.

- Highway and street-related construction spending dipped 0.2% lower in July but is up 9.7% compared to the same time last year.

- Amusement and recreation-related construction spending fell 5.3% on a monthly basis but is up 34.3% from the same time last year.

- Construction spending in the transportation category fell 0.2% on a monthly basis but has expanded 7.9% on an annual basis.

- Public safety-related construction spending fell 2.8% on a monthly basis and is down 4.9% on a year-over-year basis.

![[VIDEO] Federal Contractors Required to Pay Sick Leave](https://img.forconstructionpros.com/files/base/acbm/fcp/image/2015/09/default.55f9b716dc236.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)