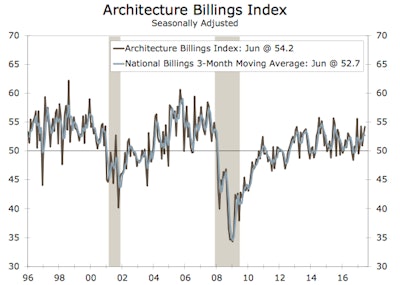

Despite reported shortages of construction workers and rising material prices, billings for construction design services advanced in June, marking the fifth straight increase in monthly billings. At 52.7 in June, the score on a three-month moving average basis is consistent with modest expenditures in total private construction spending in nine to 12 months.

Extending an almost five year stretch of positive billings, architectural services in the South posted a still-strong reading of 54.8 but eased on the month. Billings in the Northeast rebounded from its below-threshold reading of 46.5 in May to 51.5 in June, while the Midwest and West climbed to 51.9 and 53.1, respectively.

Residential jumped to its highest level in 10 months.Wells Fargo Securities

Residential jumped to its highest level in 10 months.Wells Fargo Securities

Indeed, the apartment occupancy rate has slowed from its cycle peak reached in mid-2014, and rental growth is well off its high of 5.5% reached in 2015, at 2.3% in Q1, according to data from CoStar. A comment noted in the release by a residential firm gives a good synopsis of the industry: “Activity is strong in core sectors, but costs to construct are increasing and it is more difficult to get projects started. There is more analysis and start/stop in developer processes than ever before."

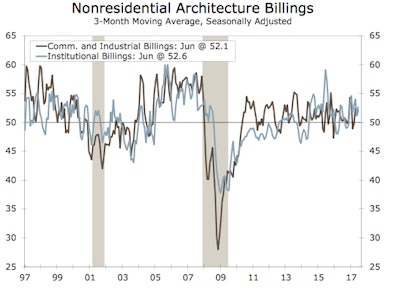

Nonresidential sectors also improved during the month with institutional (health care, education, religious, public safety, amusement/recreation, and communication) rising to 52.6 in June from 51.2 and commercial/ industrial (office, lodging, retail and warehouse) climbing to 52.1 from 51.2.

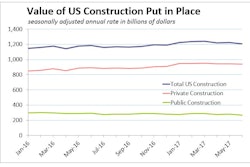

Through the first five months of the year, private institutional construction spending has moderated and is up just 4% in May relative to a year earlier, while commercial remains strong, advancing 17.1%.

Through the first five months of the year, private institutional construction spending has moderated and is up just 4% in May relative to a year earlier, while commercial remains strong, advancing 17.1%.