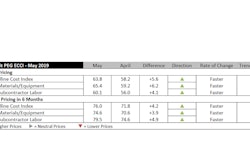

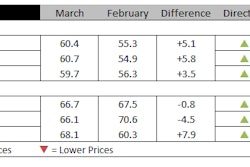

Construction costs increased in January, according to IHS Markit (Nasdaq: INFO) and the Procurement Executives Group (PEG). The current headline IHS Markit PEG Engineering and Construction Cost Index registered 54.4 this month, a slight uptick from December’s reading of 53.0, the lowest index figure for 2018. Although prices are still rising, with the index remaining above 50 for both materials and labor, these increases continue to be less widespread.

Materials and equipment prices rose in January, with the sub-index rising from 52.6 in December to 53.9 this month. Price increases were recorded in eight of the 12 subcomponents in January. Ready-mix concrete and fabricated structural steel registered flat pricing, while carbon steel pipe and alloy steel pipe once again experienced price declines. All other categories had increasing prices.

“Steel pipe prices continue to trend lower across all geographies due to falling steel input costs,” said Amanda Eglinton, principal economist, pricing and purchasing, IHS Markit. “Pipe prices in the United States will also be weighed down by the restarting of quotas on imports from Korea, Brazil and Argentina in early 2019. Price declines will level out by mid-year before moving sideways over the second half of the year, in line with the movement in steel input costs.”

Current subcontractor labor cost increases were slightly more widespread in January; the index rose to 55.7, up from 54.1 in December. Labor costs rose in all regions of the United States. In Canada, the Eastern part of the country registered flat labor costs while in Western parts, labor costs dropped.

The six-month headline expectations for construction costs index reflected increasing prices for the 29th consecutive month. The materials/equipment index slipped once more but stayed in expansion territory with a reading of 61.8. For the first time in a long while, expectations for future price increases were less widespread than in the previous month, though survey respondents continue to see costs increasing on a six-month horizon. In line with current pricing conditions, respondents noted expectations for dropping carbon steel pipe and alloy steel pipe prices. Expectations for sub-contractor labor also stayed positive at 69.7; that labor costs are expected to rise in all regions of the U.S. and Canada is not surprising given low national unemployment rates.

In the survey comments, respondents indicated a tight labor market for all skilled trade workers.

To learn more about the IHS Markit PEG Engineering and Construction Cost Index or to obtain the latest published insight, please click here.