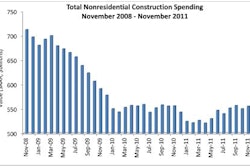

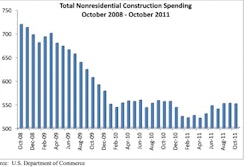

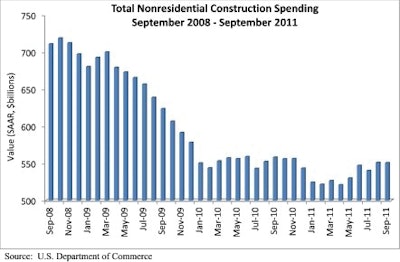

Following a 2 percent surge in August, nonresidential construction spending – which includes both privately and publicly financed construction – slipped 0.1 percent in September to a seasonally adjusted annual rate of $550.9 billion, according to the November 1 report by the U.S. Census Bureau. Year-over-year, total nonresidential construction spending is down 1.3 percent.

Private nonresidential construction spending was up 0.3 percent for the month and is 7.4 percent higher from one year ago. Public nonresidential construction spending decreased 0.4 percent for the month and is down 8.6 percent from the same time last.

One half of the sixteen nonresidential construction subsectors posted increases for the month, including health care, up 2.2 percent; communication, 2.2 percent higher; sewage and waste disposal, up 1.8 percent; and lodging, up 1.7 percent. Three subsectors experienced increased spending from one year ago with power construction spending up 19.3 percent; commercial construction 9.7 percent higher; and manufacturing construction spending up 4.7 percent.

Eight nonresidential construction subsectors had decreases in spending for the month, including conservation and development, down 7.7 percent; public safety, 4.9 percent lower; water supply, down 2.4 percent; and transportation, down 2.3 percent. With spending down in the majority of nonresidential construction subsectors year-over-year, those posting the largest declines include lodging, down 18.8 percent; religious, 16.7 percent lower; sewage and waste disposal, down 13.1 percent; amusement and recreation, 12.3 percent lower; and water supply construction, down 12.1 percent.

Residential construction spending increased 0.7 percent for the month, but is down 1.1 percent over the past twelve months. Overall, total construction spending – which includes both nonresidential and residential – rose 0.2 percent in September, but is down 1.3 percent compared to September 2010.

"Today's construction spending data is consistent with the outlook ABC has been putting forth for quite some time," said Associated Builders and Contractors Chief Economist Anirban Basu. "The notion is that nonresidential construction spending is poised for a decline in the months ahead as publicly financed construction wanes and is not fully offset by an increase in privately financed construction.

"During the past few months, publicly financed construction surged in part as a reflection of ongoing federal stimulus spending," Basu said. "However, as federally financed projects end in larger numbers, publicly financed construction is expected to dip.

"This appears to be what occurred in September. Many of the segments experiencing the largest declines in nonresidential construction were those heavily financed and demanded by the public sector," said Basu. "In contrast, privately financed construction continues to expand, such as commercial and manufacturing construction.

"Industry stakeholders can expect continued growth in health care construction for demographic and policy reasons, as well as in communications construction for reasons related to new technology and customer demand," Basu said.

"For now, the pace of recovery for the nation's construction industry remains soft," said Basu.