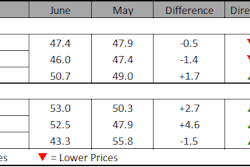

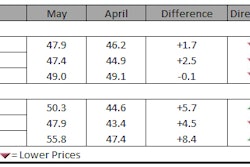

Current construction costs fell again in August, according to IHS Inc. (NYSE: IHS) and the Procurement Executives Group (PEG). The headline current IHS PEG Engineering and Construction Cost Index (ECCI) registered 45.7 this month, down from 48.8 in July and well below the neutral mark. The headline index has not indicated rising costs since December.

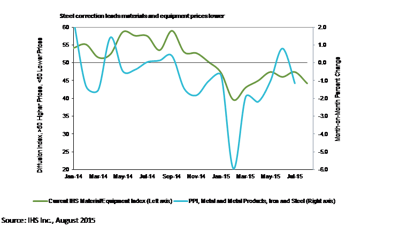

The current materials/equipment index slipped to 44.2, down from 47.4 in July. The pricing environment appears to be deteriorating with the current materials/equipment index registering its lowest reading since March of this year. The underlying detail shows falling prices for nine of the 12 individual components tracked by the survey.

Prices for steel products, however, showed particular weakness with the indexes for fabricated structural steel, carbon steel pipe, and shell and tube heat exchangers all indicating that prices are falling and that price declines have become more widespread. “Steel is a buyers’ market and will remain so,” said John Anton, principal economist, IHS Pricing and Purchasing, “Current import prices are far cheaper - up to 40 percent - than domestic prices, but if you are doing public projects with Buy America requirements, you cannot use them. However, imports can drag down prices your rivals pay, putting pressure on mills to give you similar deals.”

Pumps and compressors and turbines registered no price change. Ready-mix concrete was the only material index to register price gains in August and has been the strongest index over the year.

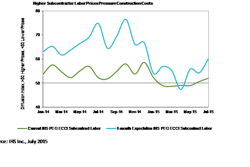

The current subcontractor labor index registered 49.1 in August, moving the index back below the neutral mark. The majority of regions reported stable subcontractor labor costs in August, with the exception of the US South. The US South continues to be the strongest region with reported tightness in skilled labor markets due to petrochemical and LNG projects in the region. Subcontractor labor costs in Western Canada moved back to neutral in August.

The six month headline expectations index fell in August, dropping to 48.6 and reversing a three month trend of stronger pricing expectations. The materials/equipment index fell to 48.8 in August from 52.6 in July. Seven individual components registered lower price expectations, with transformers leading the decline. Ready-mix concrete continued to show strong future pricing expectations, followed by turbines, pumps and compressors, and alloy steel pipe. Only the South region is expected to have higher labor costs in the next six months. Expectations for future subcontractor labor costs in the US West, Western Canada, and Eastern Canada have all moved below neutral.

To learn more about the new IHS PEG Engineering and Construction Cost Index or to obtain the latest published insight, please click here.