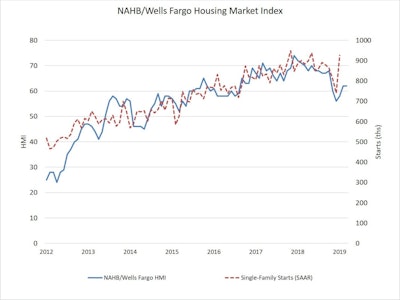

Builder confidence in the market for newly-built single-family homes held steady at 62 in March, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI). Builders report the market is stabilizing following the slowdown at the end of 2018, and they anticipate a solid spring home buying season.

In a healthy sign for the housing market, more builders are saying that lower price points are selling well. This was reflected in the government’s new home sales report released last week. In January 2018, 51% of new home sales occurred in the $200,000 to $400,000 price class. For January 2019, this share increased to 66%. This expansion occurred as higher priced home sales slowed. In January 2018, 29% of new home sales were priced in the $400,000 to $750,000 range. This market share fell to 22% in January of 2019.

Increased inventory of affordably priced homes — in markets where government policies support such construction — will enable more entry-level buyers to enter the market.

However, affordability still remains a key concern for builders. The skilled worker shortage, lack of buildable lots and zoning restrictions in many major metro markets are among the challenges builders face as they strive to construct homes that can sell at affordable price points.

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The HMI component charting sales expectations in the next six months rose three points to 71, the index gauging current sales conditions increased two points to 68, and the component measuring traffic of prospective buyers fell four points to 44.

Looking at the three-month moving averages for regional HMI scores, the Northeast posted a five-point gain to 48, the South was up three points to 66 and West increased two points to 69. The Midwest posted a one-point decline to 51.

The HMI tables can be found at http://nahb.org/hmi.