Construction News Tracker is presented by Caterpillar and produced by ForConstructionPros.com.

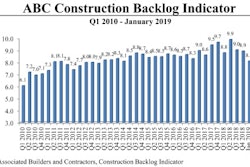

“This represents the latest in a number of indicators suggesting that U.S. economic momentum has begun to wane,” that from ABC Chief Economist Anirban Basau after the January nonresidential Construction Backlog Indicator fell 9.3%. The Indicator contracted to 8.1 months in January. And further, says Basau, other data suggests 2019 economic growth will not be as strong as last year. Indeed on March 20th the Federal Reserve downgraded its 2019 U.S. GDP growth forecast to 2.1% — much slower than in 2018. The nonresidental backlog dip in January sunk the indicator to levels not seen since 2014. Weather may have played a role, and all data indicators will be closely monitored in the months ahead.

Nonresidential building also saw a dip in February as the Dodge Data Momentum Index fell 4.4% to 146.9 from a revised January reading of 153.6. The institutional component of the index fell 5.9% while the commercial component lost 3.4%. Asawtooth pattern to the widely recognized Dodge Index has become the norm since November following a downshift last fall. This, too, bodes fear that the growth in construction is headed for moderation over the coming year as Dodge Chief Economist Robert Murray points out the fact that many projects will reach completion soon, and there is reluctance on the part of big banks to lend for multifamily projects going forward.

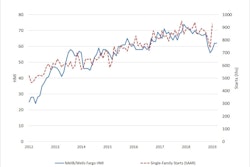

Single-family home builder confidence stabilized in March after falling off at the end of 2018, despite U.S. Commerce Department estimates that housing starts have fallen since the first of the year. The National Association of Home Builder/Wells Fargo Housing Market Index measured builder confidence at 62 for March. The government's new home sales report shows homes in the $200,000 to $400,000 price range increased to 66% as higher priced home sales dropped. Affordability and skilled worker shortages continue to hamper the nation's home builders. The NAHB survey has been compiled monthly for over 30 years.

Portland Cement Association has issued a moderate forecast of consumption growth of 2.3% for the year. The annual spring forecast from PCA envisions strong to moderate growth into 2020 for construction — a change from the fall 2018 forecast. PCA Chief Economist Ed Sullivan says private construction growth is expected to slow due to higher interest rates and cement consumption growth will follow. Sullivan goes on to say that consumption is expected to soften each year through 2021 while 2022 will see a maximum infrastructure movement.

Significant flooding in the Midwest has already caused an estimated $3 billion in damage to infrastructure, particuarly in destroyed roadways and bridges. Nebraska has been particularly hard hit with losses to agriculture interests. In Missouri, DOT officials say 120 roads were closed due to flooding including parts of Interstate 29.. Federal officials say that many do not carry flood insurance and that industry claims large areas are without up-to-date flood zone maps. It's estimated that upwards of only 10,000 insurance polcies are in effect for an area of 2 million residents.

U.S. Transportation Secretary Elaine Chao is suggesting using the expected surface transportation re-authorization bill as the main legislative vehicle to garner a broader infrastructure proposal. Chao told a Senate Appropriations Committee hearing it makes no sense to have two legislative vehicles, so she is pressing for a surface bill as the lead legislative vehicle.

IHS Markit has compiled a new report on the effect of tariffs on the off-highway equipment sector of the economy. The report claims the Administration's imposition of tariffs is costing businesses upwards of $2.7 billion monthly and causing exports of American products to drop by 37%.. Consumer spending is expected to be reduced by $23 billion per year through 2027, and job gains of 260,000 will be lost in the next 10 years. AEM President Dennis Slater says tariffs continue to take a toll on U.S. manufacturers who will have to pay significantly more in coming years to produce equipment. Caterpillar alone last October indicated the impact of tariffs on steel and other materials could cost the company between $100 and $200 million in this fiscal year.

Speaking of Caterpillar, the company has moved to collaborate with Argonne National Labratory in a unique project. They are going to explore better efficiency and reduced emissions in heavy-duty diesel engines using high performance computing, additive manufacturing, improved fidelity design and simulation models. It is one of seven private partnerships the Department of Energy has created. Their joint statement in announcing the project says they will be able to delve into the major benefits of additive manufacturing and 3D printing, which both facilities have to offer.

Fiat Chrysler Automotive says it will build a new production plant in Detroit and expand manufacturing capability at five other Michigan facilities. The $4.5 billion Detroit production plant is expected to create 6,500 new jobs for Jeep and RAM brand vehicles including four plug in hybrid and give Fiat Chrysler the ability to produce fully battery electric vehicles.

Finally, nothing derails a train of thought more effectively than listening to a person with a one-track mind.

This is Construction News Tracker looking over the industry that makes the world a better place, presented by Caterpillar and produced by ForConstructionPros.com.

Follow us on social media at Twitter using #constructionnews, YouTube and Facebook as the streaming Web never ends.